Easier access to small and medium-size companies to list their equities or bonds

On October 2019, Euronext Growth markets acquired the ‘SME Growth Market’ status. The European Union’s ‘SME Growth Market’ status was introduced under MIFID II and designed to facilitate access to capital markets for SMEs by further developing qualified markets to cater to their needs.

The SME Growth MarketMiFID II introduced the creation of a new sub-category of "Multilateral Trading Facility" (MTF): the "SME Growth Market". The objective is threefold: (1) to improve the visibility of MTFs specialising in SMEs, (2) to contribute to the adoption of common regulatory standards in the Union for these markets and (3) to facilitate SMEs' access to capital and to the European financial markets. |

What it means for companies

The ‘SME Growth Market’ status means easier market processes such as:

- the use of lighter prospectuses, at both initial and subsequent admissions, materially facilitating their capacity to raise funds on capital markets: the EU Growth prospectus and the simplified prospectus under the simplified disclosure regime for secondary issuance;

- lighter obligations under the Market Abuse regime: issuers listed on an SME Growth Market benefit from lighter insider list disclosure regime.

The EU Commission plans to introduce further regulatory alleviations.

The status is granted for companies’ equities and bonds listed on Euronext Growth Markets.

Becoming an ‘SME Growth Market’ further equips Euronext Growth Markets with the necessary tools to support SME financing, ultimately strengthening the reputation of our gateway markets for fast-growing companies. In line with its pan-European expansion, the SME Growth Market status will strengthen Euronext’s long-term commitment to forge dedicated markets with the right fit for SMEs, in Europe. For investors, it also represents an improved ability to invest in SME shares and bonds.

- CAMILLE LECA

- Chief Operating Officer Listing

- Euronext

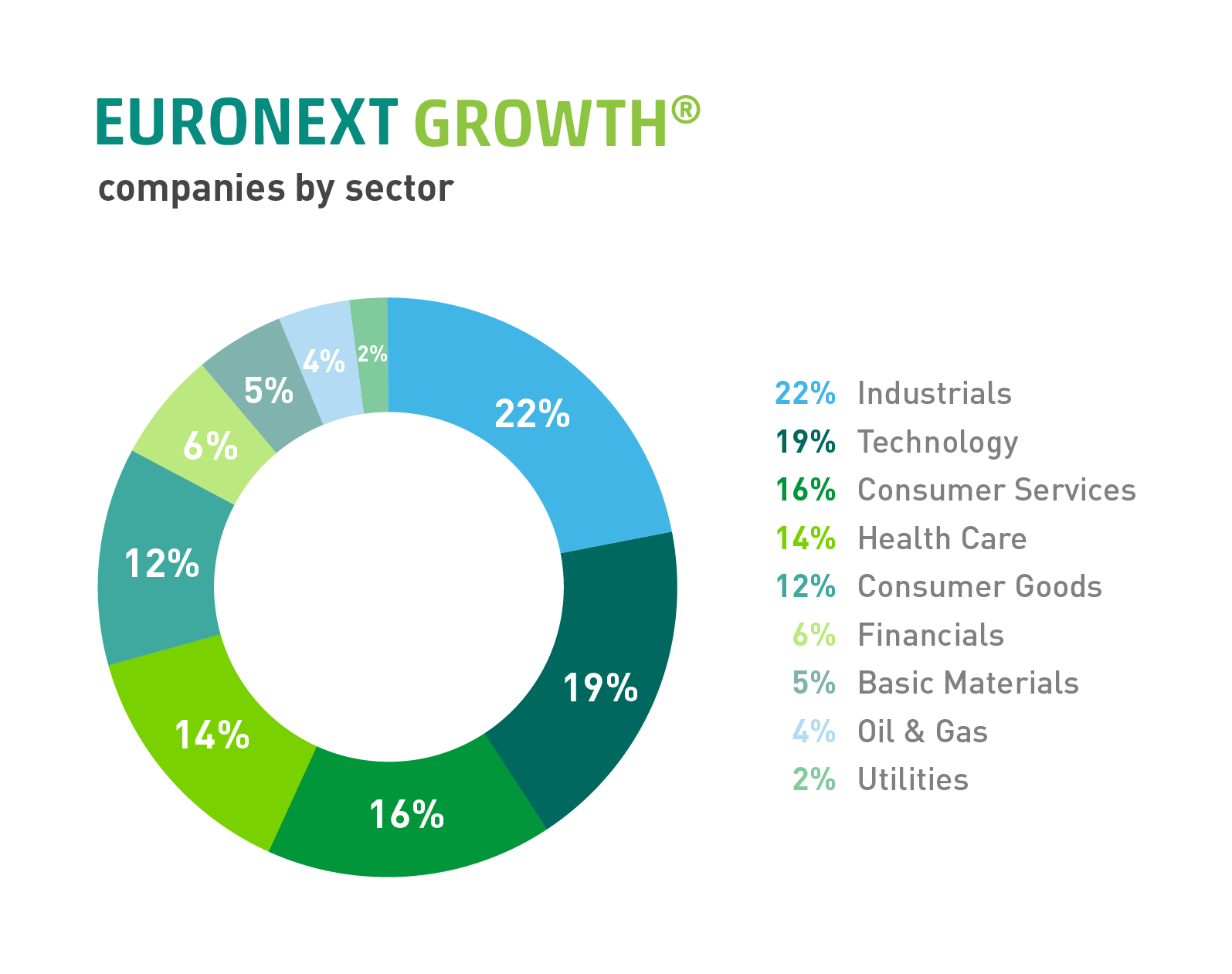

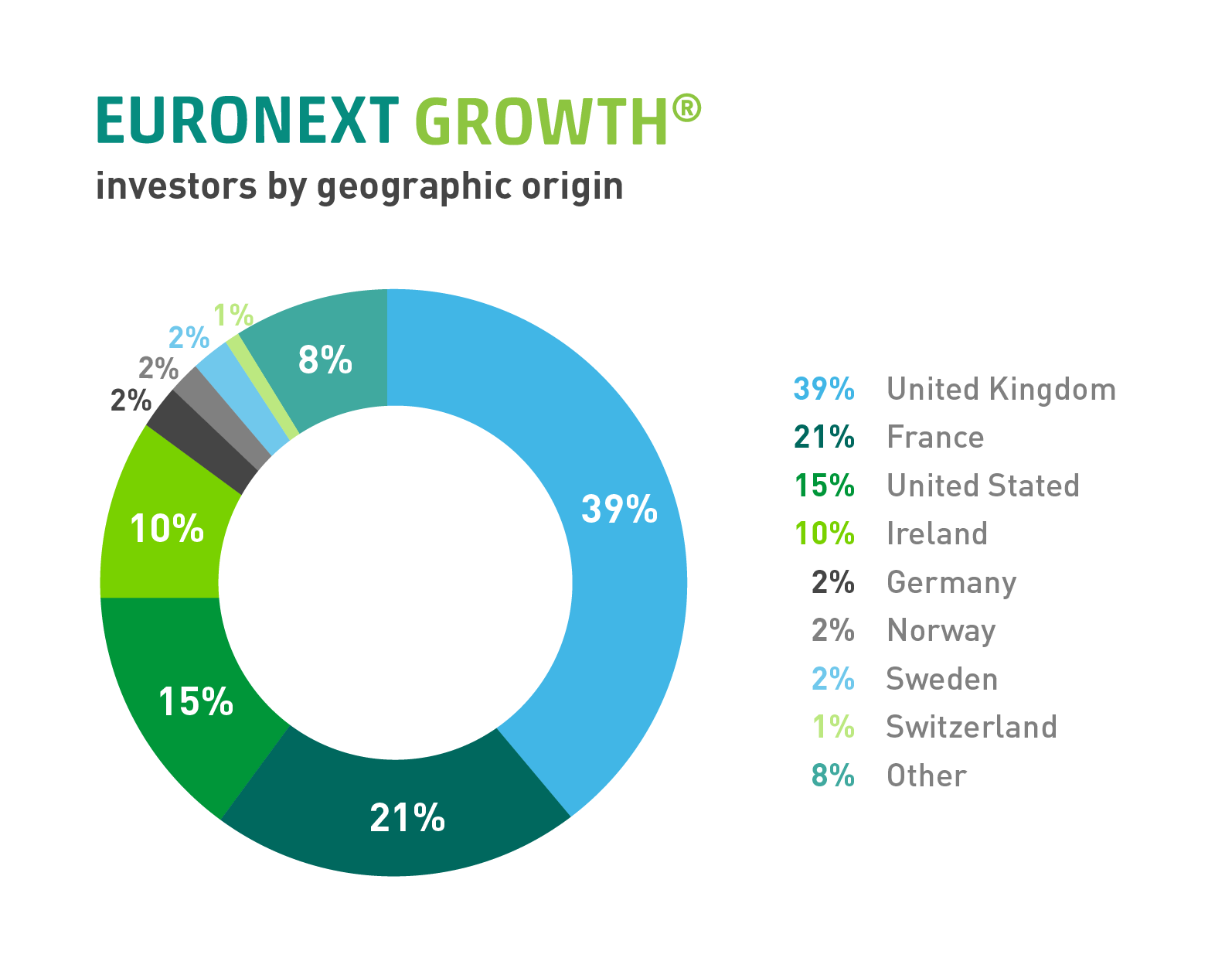

Euronext Growth, our gateway for high-growth SMEs

Euronext Growth markets (Brussels, Dublin, Lisbon and Paris) are suited to small-and mid-sized companies (SMEs) that want to raise funds to finance their growth. Listing requirements are simplified and reporting requirements are lighter than for the regulated market. Euronext Growth markets are open to both professional and individual investors and although controlled markets, they are not regulated as defined by EU directives and thus offer an alternative route for organisations that are in earlier stages of development.

Euronext Growth in key figures