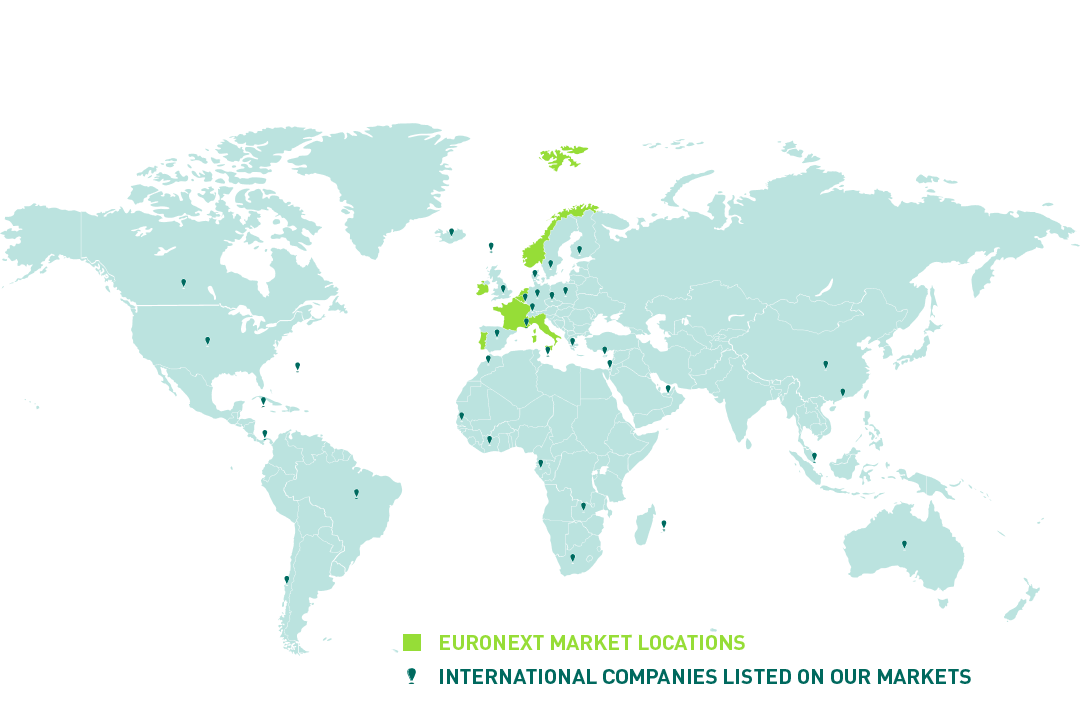

As the number one venue for equity listing in Europe and debt listing worldwide, Euronext is a gateway for international companies to access European economies and global capital markets. We operate listing venues in eight countries connected to the largest European liquidity pool through our single trading platform and are home to c. 1,900 equity issuers, out of which close to 200 are based outside our eight market locations.

-

Listing

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextRead more

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextRead moreWorld’s largest defence IPO ever recorded.

Learn more about Euronext’s initiatives to enhance financing and visibility for European aerospace and defence companies -

Trading

Where European Government Bonds meet the futureFixed Income derivativesRead more

Where European Government Bonds meet the futureFixed Income derivativesRead moreTrade Mini Bond Futures on main European Government Bonds

-

Clearing

Step into Europe’s next phase of Repo ClearingRepo ClearingRead more

Step into Europe’s next phase of Repo ClearingRepo ClearingRead moreEuronext is expanding its repo clearing services to boost market access, liquidity provision and collateral optimisation across Europe.

-

CSD

European CSD modelBuilding the CSD of Choice in EuropeRead more

European CSD modelBuilding the CSD of Choice in EuropeRead moreEuronext Securities is shaping the future of European capital markets by enhancing integration, connectivity, and innovation.

-

Technology

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read more

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read moreThe new generation of high-frequency risk trading platforms, offering the highest performance with ultra-low latency and minimal jitter, all at a low total cost of ownership.

-

Data

-

Indices

Access the white paperInvesting in the future of Europe with innovative indicesRead more

Access the white paperInvesting in the future of Europe with innovative indicesRead moreThe first edition of the Euronext Index Outlook series with a particular focus on the European Strategic Autonomy Index.

- Regulation

-

About Euronext

Euronext strategic planInnovate for Growth 2027Read more

Euronext strategic planInnovate for Growth 2027Read moreShaping capital markets for future generations