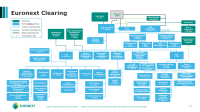

Euronext Clearing has adopted an Emir compliance governance to protect its Client from financials and operational risks with a traditional system of administration and control, whereby corporate management is the responsibility of the Board of Directors and control functions are allocated to the Board of Statutory Auditors.

Euronext Clearing’s Corporate Governance system is based on the following:

- Board of Directors, responsible for the strategic guidance and supervision of the Company’s overall business activities, with policy-making powers in relation to the overall administration and the authority to intervene directly in a series of significant decisions necessary or useful to achieve the company purpose;

- Independent Directors who are directly committed to task where there are potential conflict of interests, such as: risk management and remuneration of the board members and key staff involved on control functions;

- Board of Statutory Auditors, which is composed of independent members directly appointed by Shareholders, which also acts as Audit Committee and, according to the Italian Corporate Law, is entrusted with the responsibility of supervising a wide set of aspects, ranging from the compliance with the law and the Company Bylaws, to the efficiency of the internal control system, the internal audit system and the risk management system; statutory audit of the annual accounts; the independence of the statutory auditor or the statutory audit company;

- an effective internal control system and pro-active risk management system;

- a strict discipline concerning potential conflicts of interest and solid principles of conduct.