On 27 March 2023, Borsa Italiana equity markets migrated onto Euronext Optiq® platform. What can we observe 6 months later?

Take a look at this newsletter and our latest equity trading market quality report to discover how market quality has recently improved on Euronext Milan compared to the main MTFs.

Simon Gallagher

Download equity trading market quality report

Highlights

- Price formation

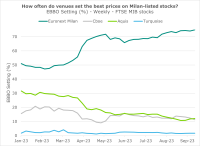

Euronext now sets the best prices on Milan most liquid stocks 74.5% of the time, +24.9 percentage points higher than before the Optiq migration.

In comparison, each of the main MTFs has instead EBBO Setting below 13%. - Market quality metrics

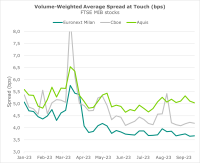

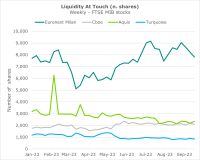

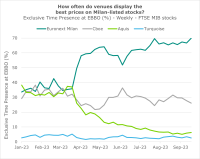

Euronext Milan offers the tightest spread at touch (<3.7bps), the largest liquidity at touch (8,000 shares around the BBO) and the highest Exclusive Time Presence at EBBO (68%) compared to the Central Limit Order Book of Cboe, Aquis and Turquoise. - Aggressive trades

When considering all trades from Equiduct APEX, retail gross trade prices on Italian stocks for Equiduct are worse by 1.60bps compared to Euronext Milan.

The net improvement of Equiduct prices compared to Borsa Italiana is negative also when taking explicit trading fees into account. - Share of Lit trading

Borsa Italiana now captures a record high 80.5% of lit continuous and auction turnover for Milan-listed stocks.

It is +4.7 percentage points higher compared to March 2023 pre-Optiq.

| Euronext Milan | Cboe | Aquis | Turquoise | ||

|---|---|---|---|---|---|

| EBBO Setting (%) |

Before Optiq | 49.6% | 18.5% | 29.2% | 2.7% |

| September 2023 | 74.5% | 12.3% | 11.6% | 1.7% | |

| Variation | +24.9% | -6.2% | -17.6% | -1.0% | |

| MTF vs Euronext | -- | 6.1x worse | 6.4x worse | 44.9x worse | |

| Spread at Touch (bps) |

Before Optiq | 4.8 bps | 5.4 bps | 5.5 bps | 17.5 bps |

| September 2023 | 3.7 bps | 4.2 bps | 5.2 bps | 11.2 bps | |

| Variation | -1.1 bps | -1.2 bps | -0.3 bps | -6.3 bps | |

| MTF vs Euronext | -- | 0.5 bps worse | 1.5 bps worse | 7.5 bps worse | |

| Liquidity at Touch (n. shares) |

Before Optiq | 7,188 | 1,883 | 3,328 | 1,215 |

| September 2023 | 8,229 | 2,109 | 2,290 | 859 | |

| Variation | +1,041 | +226 | -1,038 | -356 | |

| MTF vs Euronext |

-- | 3.9x worse | 3.6x worse | 9.6x worse | |

| EBBO Exclusive Time Presence (%) |

Before Optiq | 36.5% | 33.4% | 33.6% | 4.2% |

| September 2023 | 68.0% | 27.8% | 5.7% | 2.9% | |

| Variation | +31.5% | -5.5% | -27.8% | -1.3% | |

| MTF vs Euronext | -- | 2.4x worse | 11.8x worse | 23.5x worse |

Euronext is the venue for price formation also in Milan

- Since the migration of Borsa Italiana equity markets onto Optiq® on 27 March 2023, Euronext Milan has experienced a striking improvement up to 74.5% EBBO Setting – while the MTFs now set the best EBBO less than 13% of the time.

Data source: BMLL Technologies

Borsa Italiana is further improving its market quality

- Euronext Milan offers the tightest spreads on Italian blue-chip stocks, compared to the Central Limit Order Book of Cboe, Aquis and Turquoise:

Note: Turquoise Europe not displayed in the chart because spread is much higher (15bps Year-to-Date)

- Euronext Milan offers Liquidity around the BBO (in number of shares) which is 4-9x higher compared to the Central Limit Order Book of the main MTFs:

- Since the Optiq migration, the Exclusive Time Presence at EBBO has increased sharply for Euronext Milan – up to 68% i.e. 2-10x better than largest MTFs.

Data source: BMLL Technologies

Comparing Borsa Italiana and Equiduct APEX executionsA research study was published to analyse the performance of aggressive executions on Italian stocks, by comparing Lit trades on Borsa Italiana with the Equiduct MTF.

|

Who is driving improvements of Euronext Milan?

- The contribution of (a) strong presence of local brokers attracting retail and institutional flow, (b) global banks ramping up their activity in Milan, and (c) market makers fulfilling the strong requirements of the SLP (Supplemental Liquidity Provider) scheme which was implemented on 27 March 2023 for FTSE MIB stocks.

- Such multilateral interaction of flow resulted in record high Lit share of trading (continuous & auctions) for Euronext Milan, now at 80.5%.

|

Euronext Milan |

Cboe Europe |

Aquis Europe |

Turquoise Europe |

Equiduct |

|

|

Jan-2023 |

75.8% |

15.1% |

6.6% |

2.0% |

0.6% |

|

Feb-2023 |

77.1% |

14.2% |

6.2% |

1.9% |

0.6% |

|

Mar-2023 |

75.8% |

15.8% |

5.8% |

2.1% |

0.5% |

|

Apr-2023 |

77.7% |

14.3% |

5.6% |

1.9% |

0.6% |

|

May-2023 |

77.3% |

15.9% |

4.7% |

1.8% |

0.4% |

|

Jun-2023 |

78.3% |

15.1% |

4.3% |

1.8% |

0.5% |

|

Jul-2023 |

78.3% |

15.2% |

4.0% |

1.9% |

0.6% |

|

Aug-2023 |

79.6% |

14.6% |

3.6% |

1.7% |

0.5% |

|

Sep-2023 |

80.5% |

14.0% |

3.4% |

1.6% |

0.6% |

|

Variation Sept vs March (pre Optiq) |

+4.7% |

-1.8% |

-2.4% |

-0.5% |

+0.1% |

Data source: BMLL Technologies

The Euronext Equities team at events

Euronext Sustainability Week

Webinar - Sustainable Trading: How ESG is getting closer to trading desks

ESG (Environmental, Social and Governance) is becoming an increasingly significant aspect of the decision-making framework for all financial firms. It’s not just about making more sustainable investment choices; sustainability requires all participants in the investment supply chain, from brokers to technology providers, to address sustainability challenges and champion ESG best practice within and across their own operations.

Listen to Chris Topple, CEO of Euronext London and Head of Global Sales and Duncan Higgins, CEO of Sustainable Trading, discussing ESG insights and best practices within financial markets.

More Euronext Sustainability Week

International Trader Forum

5-8 September, Barcelona

This year again, we were thrilled to engage with global buy-side and sell-side communities during the conferences and our round robin session where Simon Gallagher and Vincent Boquillon presented our newest equity trading initiatives and Paul Besson, Euronext’s latest quantitative research.

We were proud host of the dinner held at the beautiful Can Magí venue, a relaxing moment with 300+ peers.

See you next time in Rome!

The Euronext Equities in the media

Financial News, 28 September 2023

Euronext to expand MTF with more US and European stock offerings

Check out our insights on LinkedIn this month

Click on the links below:

What happened during the summer break? Euronext market quality keeps improving.

The power of the federal model - after the striking improvement in market quality thanks to the Optiq migration on 27 March, Euronext Milan has further improved its EBBO Setting performance since June.

Euronext market quality release: Equity trading “Made in Italy”

For more information

Don't hesitate to contact your sales representatives with any queries or feedback.

Thank you!