Welcome to ‘Inside Euronext Markets’

To wrap up this year, we are thrilled to present you with the latest edition of our newsletter, providing you with all the news and updates of the European Equity Capital Markets from the past six months. This newsletter is published twice a year.

Through this newsletter, we aim to bring you an opening overview of the year and insights of market activities of H2 2020, tailored articles on different sides of the Euronext businesses, as well as an overview of some of the events we organised in 2020.

We hope you enjoy this newsletter, wish you a pleasant read, and a happy holiday season!

Market views

Editorial from Anthony Attia, Global Head of Listing & Post-Trade

Estimated reading time: 2 minutes, 25 seconds

2020 was heralded as the year of possibilities and growth, but has challenged the world in unprecedented ways.

Throughout the year, we saw and felt the impact of the global Covid-19 pandemic worldwide. Across Europe, businesses, particularly smaller ones, suffered from the crisis. In July, the European Union agreed to a long-term budget of €1.8 trillion to secure citizens’ livelihoods and protect the economy in a post-Covid-19 era.

The financial sector was shaken, from extreme volatility (the VSTOXX volatility index reached a high of 85.62 points on 16 March 2020) and turbulent index performances; and initially, uncertainty overshadowed the potential stabilisation of the situation. However, our markets remained resilient while we renewed our efforts to maintain normal market activities and continue to provide high-quality support for our clients.

This pandemic has led the industry to adapt our communication methods, with the majority of interactions moving online. We helped companies rethink the organisation of their general meetings and IPO ceremonies, and provided updates on markets, regulation and other key topics, to ensure our clients could stay on top of the latest information.

Supporting companies on their financing journey remains at the core of our mission, whatever the environment. Our listing activity remained strong with 85 new listings (at 18 December 2020) compared to 45 in 2019 (at end 2019). €49.7 billion was raised through follow-on offerings (+48% vs 2019) and €6.67 billion was raised through new listings (+42% vs 2019). We have developed new Index offerings, and dedicated financial and regulatory advisory services to assist our newly listed clients.

We continued to develop and enhance our proprietary services, including the expansion of our Corporate Services offering, and our growing training programmes initiative: TechShare, IPOready, PE Share and GO Public.

Financial markets have also put Environmental, Social and Governance (ESG) issues at the top of the agenda, due to an increased demand for ESG assets and products. This year saw the harmonisation of the FESE reporting guidelines across the Euronext marketplaces, in line with our ESG focus as part of our ‘Let’s Grow Together 2022’ initiative, which has clarified the process of reporting on ESG issues for companies. We also saw a significant number of Green convertible bonds and Cleantech operations recorded on our markets this year, further emphasising the need to increase the focus on sustainable finance activities.

For all its peculiarities, this year marked 20 years of Euronext as a company and was underlined by several accomplishments, including a binding agreement for the contemplated acquisition of the Borsa Italiana Group. We look forward to welcoming the Borsa Italiana Group as a new member of Euronext during H1 2021, once all conditions precedents for the transaction have been met. These developments provide a positive perspective for 2021, demonstrating that even in times of uncertainty, capital markets remain resourceful and dynamic, with ability to adapt and retain interest. Despite the likelihood that the aftermath of this global crisis will be felt throughout the coming year, the number of listing operations planned for coming months is steadily growing and we remain optimistic that it will continue to do so. We saw particularly strong market activity in Norway over the past six months, showcasing the strength of the Nordic marketplace. The recent migration of Oslo markets to our proprietary trading platform, Optiq®, further reinforces our successful expansion in Europe.

Whilst challenging and unprecedented, the events of the past year have made us stronger as a company and allowed us to, together, reinforce the bonds between the public and private financial spheres, to understand more how to evolve in accordance with our clients’ needs, and how to provide the best services to our ecosystem. The past two decades have been marked by milestones, with world firsts and records surpassed, as well as exponential growth. We have proved ourselves to be an entity to be reckoned with, and one that is here to stay.

Anthony Attia,

Global Head of Listing & Post-Trade, member of the Euronext Managing Board.

Latest happenings on the capital markets

European capital raising in 2020: high points amid high drama

Estimated reading time: 2 minutes, 7 seconds

Amid the turbulent times of 2020, Euronext has worked hard to keep capital markets open, enabling money to flow into companies that might find solutions to tomorrow’s pressing problems.

As the year closes, we can say that even in these difficult circumstances, there were high points amid the high drama.

Stock markets certainly put in a dramatic performance. In Europe, stock markets initially plummeted on news of the pandemic, but had made up most of the lost ground by late 2020. They were bolstered initially by central bank action and government spending, and then, from November, by breakthroughs in finding vaccines. In the United States, the S&P 500 slumped in February and early March, but eventually rose to record levels as the coronavirus accelerated the move to a global digital economy, boosting tech stocks.

Stock market volatility was reflected in the shape of the IPO year. Euronext saw a spring lull in IPOs – but as stock market sentiment recovered, IPO activity quickly returned in May. A small but steady stream of flotations then came in, before a sudden flourish in November, as good news for coronavirus vaccines boosted stock valuations. The Norwegian market was particularly active, with record listing numbers reached and a number of hallmark operations performed by Link Mobility (€549 million raised), Pexip (€237 million), and BW Energy (€114 million), while the tech sector saw a boost in activity on the Belgian market with the introduction of Nyxoah (€251.6 million) and Unifiedpost (€549.1 million) this autumn. Furthermore, the US lost a potential new market player to Euronext Dublin, where Trust Stamp listed in early December. All in all, Q4 saw 32 new companies list, accounting for 43% of the deals YTD and raising €1.6 billion.

A new trend emerged in the last months of the year, in the listing of SPACs, the Special Purpose Acquisition Companies that, until recently, had mostly prospered in the US. The IPO of Dutch Star Companies TWO (€110 million) in Amsterdam, from the Dutch Star Company group, followed the success of sister company Dutch Star Companies ONE in 2018, which subsequently merged with CM.com and listed on the Dutch market in early 2020. Meanwhile, 2MX Organic (€300 million), the SPAC created by three renowned French entrepreneurs, Xavier Niel, Matthieu Pigasse and Moez-Alexandre Zouari, entered Euronext Paris through a direct listing in early December. This last was part of the direct listing surge that occurred throughout the year, jumping from 22 listings in 2019 to 58 in 2020. Direct listings can be attractive because the listing company dispenses with an investment bank, which charges fees for underwriting an IPO.

In the US, IPO activity was also hit in the spring, before bouncing back to see a strong autumn.

A busy time for convertibles

The convertible bonds market had a busy year. This makes sense: convertibles are more attractive to investors when markets are volatile, because this increases the chance that the underlying stock price will reach a level high enough to make converting them attractive. This year’s issuers were mainly tech companies. They often like convertibles because the coupons are lower than for conventional bonds, allowing them to minimise interest payments when they are in a high-growth, cash-hungry phase. Fifteen companies issued €6.95 billion of convertibles debt on Euronext exchanges in 2020 – a 34% increase on the year in funds raised.

Looking to the future, one trend that we see continuing is the IPO hunger among tech firms. November’s late harvest included a slew of interesting examples. Xplora, which listed in Oslo, addresses two particular parental preoccupations of the hour – keeping children safe, and keeping them healthy – by making smartwatches for children that can monitor where they are and encourage them to be active. Another Oslo flotation, Huddlestock Fintech, helps financial companies with digital onboarding and other services. Alchimie, which launched in Paris, acts as the link between people who make video content and their subscribers. We can’t wait to see what innovative companies with novel solutions will list on Euronext exchanges in 2021.

Don’t miss

Listed companies: overview of the main European regulatory developments expected for 2021

Estimated reading time: 2 minutes, 18 seconds

As 2020 draws to an end, the European Commission continues with its action plan to support listed companies. Learn about the key measures that will be discussed for 2021.

#1 A package of measures dedicated to the Capital Markets Union

Shaken by the coronavirus crisis and still grappling with Brexit, the European Union and its political bodies aim to take advantage of 2021 to pursue the development of a single EU-wide capital market.

To achieve this aim, the European Commission has committed to 16 measures to enable the capital markets to support the economic recovery.

The proposals being considered feature:

- a desire to simplify listing rules for SMEs;

- the establishment of a crossover fund to support SMEs with their IPOs;

- the creation of a single European access point, giving investors continuous access to financial data and company sustainability information;

- the possible introduction of a European definition of "shareholder", as well as the clarification and harmonisation of the rules governing interaction between investors, intermediaries and issuers, making use of new digital technologies.

#2 Simplification of the MiFID II directive and the Prospectus Regulation

To support the recovery of EU economies, on 24 July the European Commission proposed a package of legislative measures aimed at simplifying the MiFID II directive and the Prospectus Regulation. The Commission, Council and Parliament recently reached political agreement on these proposals.

The amendments to the MiFID II directive, known as the MiFID II “Quick Fix”, involve targeted measures to ease regulatory constraints on intermediaries and issuers. SMEs with a market capitalisation under €1 billion are exempted from financial intermediaries’ bundling rules (i.e. the obligation to separate research fees from brokerage fees).

In addition, changes to the Prospectus Regulation have been agreed on with the objective of providing listed issuers with simplified information disclosure rules for a period of 18 months, to enable companies to access new funding rapidly to help with the economic recovery from the Covid-19 pandemic. The EU Recovery Prospectus would be easier to produce for companies seeking to raise equity on the capital markets via (and limited to) secondary issuances on a Regulated or SME Growth Market. While issuers would benefit from a shorter approval process, the prospectus would have the added benefit of being easy to understand for investors.

#3 Introduction of the European single electronic format

A symbol of commitment to European integration, companies listed in the European Union must publish their annual financial report in the European Single Electronic Format (ESEF) for financial years starting on (or after) 1 January 2020. This measure would reinforce requirements for companies currently subject to IFRS to use Inline XBRL technology and tagging.

However, it has been agreed by the European legislator that due to the Covid-19 crisis, EU member states could decide to delay the requirements and authorise issuers to start complying with this requirement for financial years starting on (or after) 1 January 2021.

With the desire for economic recovery taking centre stage, European integration and regulatory rationalisation are sure to be the keywords for 2021.

New corporate governance challenges: why you need to be ready

Estimated reading time: 3 minutes, 31 seconds

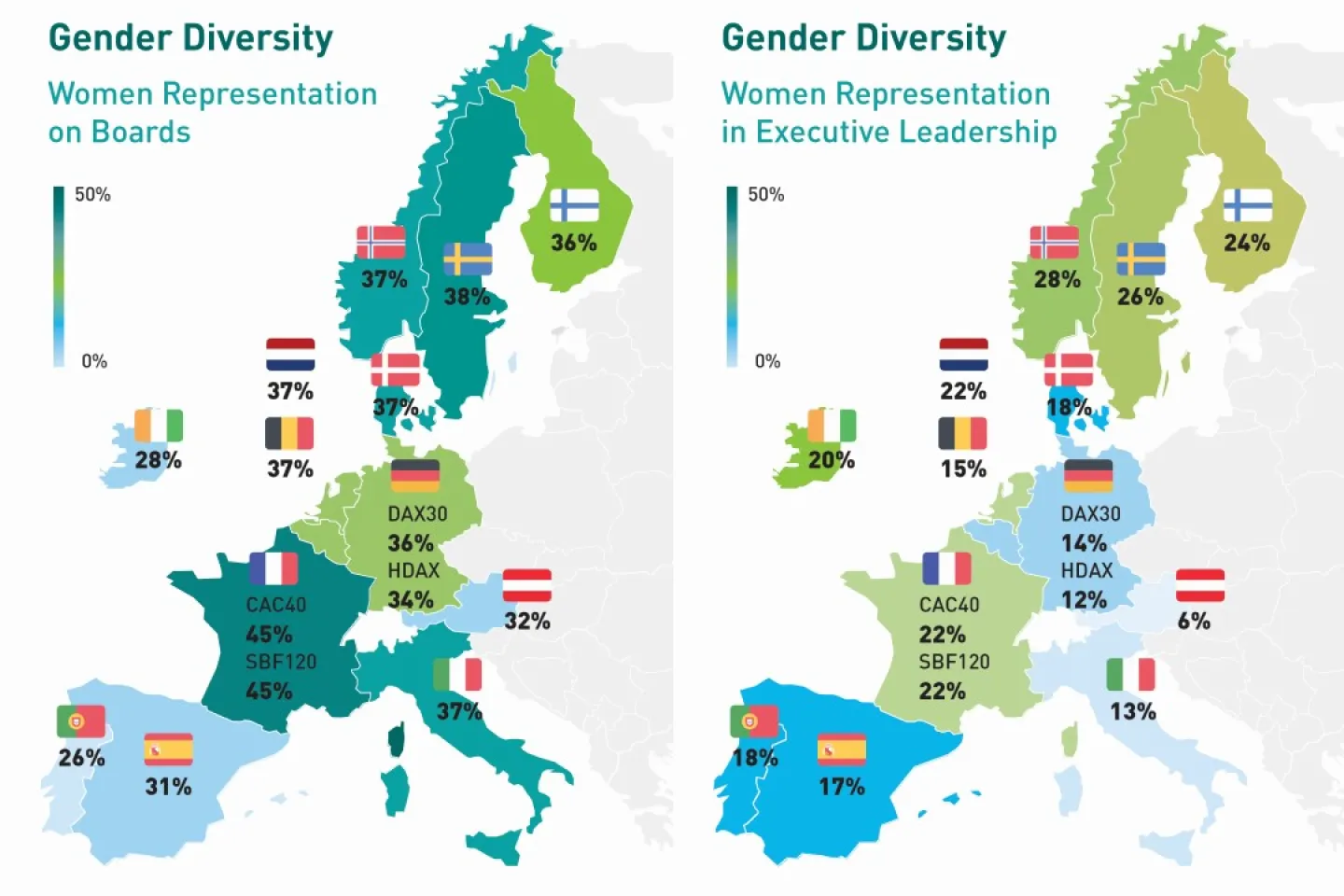

So what are the new corporate governance challenges?

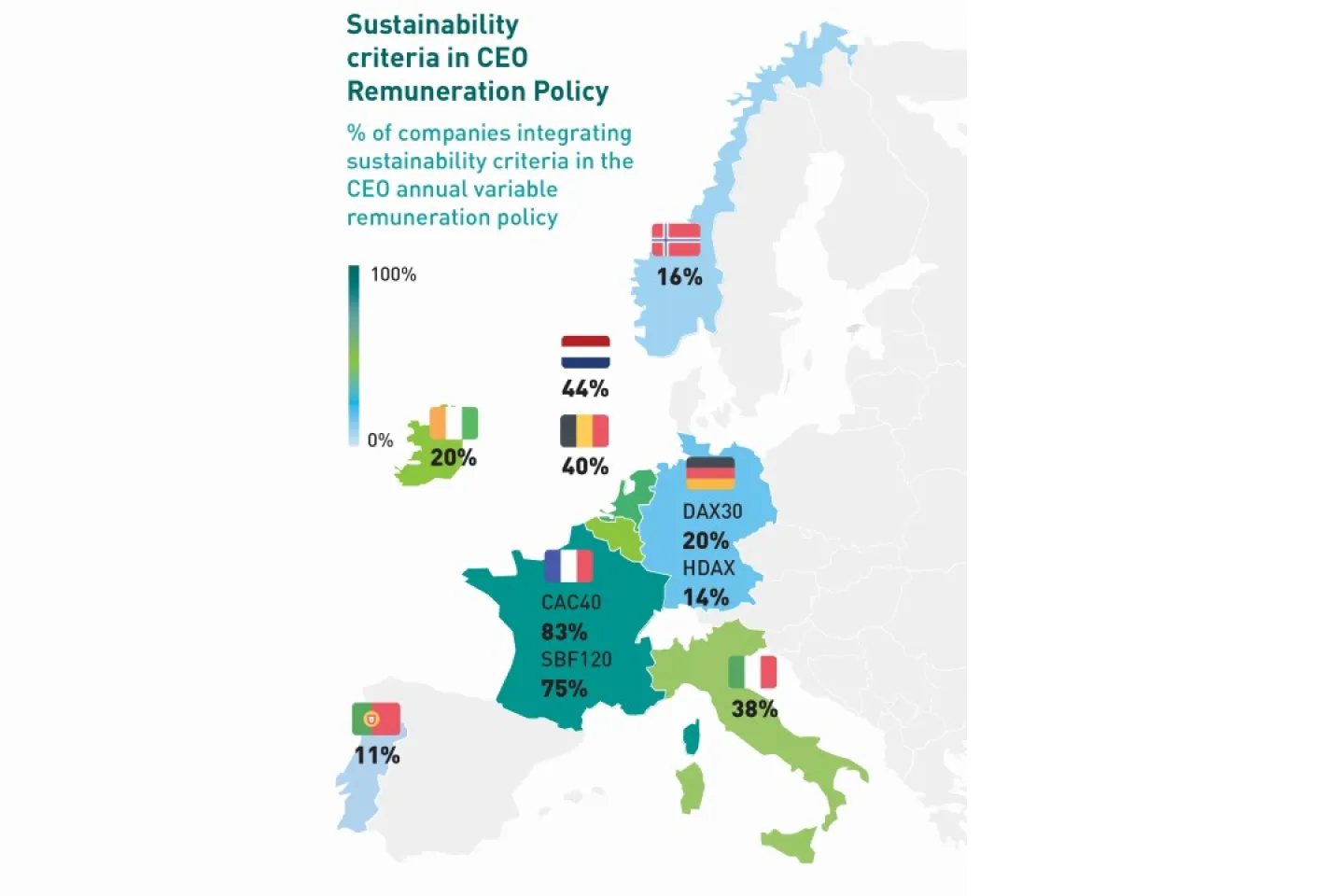

#2 Executive pay: ESG criteria and transparency

#3 Increasing engagement in ecological transition

Euronext has more than 40 ESG themed indices that can help analyse companies’ ESG performance. The Euronext Eurozone ESG Large 80 index has gained 19% over the last year[1].

These challenges are highly topical and we have to adapt to them. Training managers in this area is a key part of initiating changes in outlook and improving communication. Euronext offers an advisory service to help companies finetune their ESG strategy and enhance their governance. We can also provide software to facilitate the use of digital technology at general meetings, ensure security for board meetings and help assess investor expectations in terms of ESG reporting.

In conclusion, companies’ efforts to improve ESG practices give them better visibility among investors and can also lead to inclusion in certain ESG-specific indices. Lastly, these good practices can help companies withstand a crisis such as the current one: according to the 2020 Edelman Trust Barometer, 91% of institutional investors consider companies that uphold ESG criteria to be more crisis-proof. All the more reasons to consider preparing for these new challenges.

Discover our services and our guide to good ESG reporting practice

Camille Leca

Chief Operating Officer Listing Euronext

Sources:

BlackRock sustainable investing survey

Edelman Trust Barometer

EY / Royal London paper

Fidelity ‘Putting Sustainability to the Test’ report

The year of the cleantech explosion

Estimated reading time: 2 minutes, 28 seconds

2020 has seen a wonderful range of cleantech listings arrive on our exchanges. Throughout the year we welcomed 17 new cleantech listings, raising €558 million. Fifteen of these were welcomed by our Oslo market, cementing its position as one of the world’s leading cleantech exchanges. In terms of follow-on offerings side, our pan-European markets saw €1.27 billion raised. These are good signals that, beyond the thriving green debt market (€108 billion on our markets so far in green debt and ESG in 2020 alone), equity capital can be readily made available to finance the transition of our economy into a more sustainable system.

This large number of cleantech listings follows a trend we have seen accelerating in recent years, now culminating in 83 cleantechs listed on Euronext markets, for a total aggregated market capitalisation of over €57 billion.

Last month a research report from Bank of America shed some light on the impact that clear-cut decisions from the resolutely eco-friendly attitude of Generation Z[2] is going to have on the world of investments. Beyond Gen Z, the wider retail investing community has common interests at heart: according to Allianz Global Investors, 75% of European retail investors are interested in investments that could increase their wealth without harming people and planet – in other words, “sustainable investments”.

Beside the growing body of empirical research, and the concrete example of funds performances, showing that investing in a responsible fashion does not harm investment returns, and may in fact boost them, professional investors are becoming keener on sustainable assets, encouraged in some degree by the regulation. A good illustration is found in the taxonomy currently being drawn up by the EU, which will earmark economic activities as having either a positive or a neutral impact on common good.

All of these driving forces are welcome, whether generational or regulatory, simply because we need this money on the side of the climate. We need more, and specifically, more equity. To paraphrase the ECB, it will be difficult to sustain a climate transition if it is entirely financed by debt.

The United Nations has set out 17 Sustainable Development Goals (SDGs). These include SDG 7: Affordable and Clean Energy – where our cleantechs can lead the way. The UN office has also calculated an annual gap of USD2-3 trillion between what is currently spent on the SDGs, and what is actually needed to fulfil the set goals. This shows a huge market opportunity. The size of the challenge also means that cleantech companies need a tremendous amount of capital to scale up their services.

And that’s where we, at Euronext, can play a crucial role. We aim to encourage more cleantechs to access capital markets to support the next stage of their growth, because investors’ demands for sustainable assets are likely to be here to stay.

Joel Dibeton

ESG Lead Listing Business Euronext

Navigating Capital Markets

Estimated reading time: 2 minutes, 5 seconds

At Euronext Corporate Services we support issuers in navigating the capital markets effectively with a wide range of cutting-edge solutions and tailor-made advisory services. Our services focus on the most critical needs of companies, supporting them in areas such as increasing their visibility, enhancing the impact of their communication, understanding financial markets, increasing investor engagement and improving their governance. In this edition we introduce you to the latest: a brand new professional webinar studio, a new investor relations CRM and targeting tool, and an upcoming suite of compliance products.

Bringing professional webinars to Paris

Amidst the lockdown and social distancing measures brought about by Covid-19, organisations were forced to adapt quickly, and webinars quickly became the “new normal” for companies to communicate their most important messages to a broader audience, meet investors virtually or even host IPO-related virtual roadshows.

In September, Company Webcast, a subsidiary of Euronext Corporate Services, made professional webinars even more accessible to our more than 100 clients in France, by opening a state-of-the-art webinar studio in the centre of Paris. The studio, which is Company Webcast’s fifth in Europe, allows organisations in France to record and broadcast truly professional TV quality webinars in order to communicate and engage with their employees, prospects or customers, regardless of where they are in the world.

Optimise your IR workflow with the next generation IR.Manager

In an increasingly challenging capital markets industry, it is crucial for investor relations professionals to be able to seamlessly engage with current and potential investors, with a more autonomous connection to the buy-side and sell-side worlds. To support this, Euronext Corporate Services recently launched the next generation IR.Manager, the new cloud-based version of our already powerful investor relations CRM and targeting platform.

The next generation IR.Manager is designed to simplify access to capital markets stakeholders for IR professionals. You can now manage all of your IR tasks, including tracking your ownership, targeting new investors, managing your interactions and reporting on investor engagement, in one intuitive and user-friendly platform, from anywhere. Curious how the next generation IR.Manager can support your IR roadmap? Book your pre-live demo here.

New compliance products in development

At Euronext Corporate Services, innovation is at the heart of our goal to support our clients on their capital markets journey. That means listening to feedback and evolving our product portfolio to suit the evolving needs of our customers.

In a recent client survey, InsiderLog, our insider list management tool, received an impressive customer satisfaction score of 97%. In the same survey, we also enquired about our customers’ level of interest in other potential upcoming compliance products and received an overwhelmingly enthusiastic response. As a result, we now have several exciting products in development including a whistleblowing tool and an employee trade monitoring solution. Watch this space!

You can stay up to date with the latest news in Euronext Corporate Services by visiting our website or following us on LinkedIn.

Mathieu Caron,

Head of Euronext Corporate Services

Convertible bonds and Green convertible bonds: ESG transactions driving alternative financing options in Europe

Estimated reading time: 1 minute, 35 seconds

A convertible bond is a debt and equity instrument that provides an investor with a right or an obligation to exchange the bond for a predetermined number of shares in the issuing company, or one of its subsidiaries, at certain times in the bond’s lifetime. Like a standard bond, it features a maturity and pays its holder with interest until its conversion into equity. The conversion from the bond to shares happens at specific times during the bond’s life and is usually at the discretion of the bondholder. Convertible bonds are often attractive to investors who are reluctant to enter capital directly, as they can ‘convert’ their holding into either shares or cash. This makes convertible bonds an excellent vehicle to attract investment into ESG related companies and initiatives.

Euronext Paris: leading the way with ESG convertible bonds

2020 has seen three major and innovative ESG-related convertible bonds issued on the Euronext Paris market, putting it at the forefront of ESG convertible bond issuances in Europe:

Neoen opened the market in May with the first ever green convertible bond in Europe for an amount of €170 million.

EDF, the leading provider of energy in Europe, successfully issued a €2.4 billion green convertible bond in September

Most recently, Schneider Electric, the global leader in energy and automation digital solutions for efficiency and sustainability, issued the world’s first ever Sustainability-Linked convertible bond in November totaling €650 million, based on ambitious targets in the reduction of CO2 emissions, gender diversity and training for underprivileged people.

Why choose to issue convertible bonds?

Convertible bonds can help you optimise your funding costs. As an issuer of a convertible bond, you can benefit from advantages associated with both equity and debt funding methods:

- Reinforce your capital structure in the long term:

- The issuing company benefits from potential new shareholders, while delaying their entry into the company’s capital and thus potential dilution of associated voting rights.

- An increase in the stock price contributes to the appreciation of the convertible bond, which supports the performance of the stock.

- Increase investor confidence

- Investors reluctant to enter capital directly may prefer convertible bonds in order to subscribe to new shares on a deferred basis.

- Holders can redeem their debt either in an allocation of shares in the company or in cash.

[1] At 22 December 2020

[2] The generation born between 1993-1998.