The index designed to represent performance of stocks across 23 developed markets.

Why invest in the developed world?

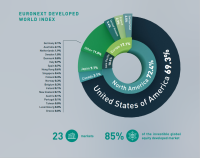

The Euronext Developed World Index is designed to represent performance of a set of large and mid-cap stocks across 23 developed markets. The index covers at least 85% of the free float market capitalisation of global developed markets and across each country.

The index is calculated in euro and rebalanced semi-annually. The constituents of the index are weighted according to their free float market capitalisation ensuring replicability through liquidity screening.

Key Principles of Euronext Developed World Index

Global Coverage

The Euronext Developed indices provide exposure to the world’s leading developed markets. Our indices intend to represent the dynamism of the global economy offering a diverse array of investment opportunities, covering 23 developed countries.

Free Float Market Capitalisation

The Euronext Developed indices are selecting and weighing companies based on their Free Float Market Capitalisation. Focusing on companies’ public ownership ensures the fair representation of the benchmark. It provides a more accurate reflection of market movements and stocks actively available for trading in the market.

Transparent Methodologies

The suite of indices follows a transparent methodology that guarantees the reliability and accuracy of the benchmark. Transparency regarding users should therefore be the main tool for market players to make an informed choice of the benchmarks they consider appropriate for their use.

The Euronext® Developed World Index provides opportunities for the creation of a wide range of investment vehicles, such as ETFs, funds and structured products.

Learn more about Euronext Developed World Index:

Euronext Developed World Index Live Quotes

Developed World Index Rules | Developed World Index Factsheet

The Developed World Index is part of a broader suite of indices covering 85% of the floating market capitalisation of their respective universe.

|

|

Watch the Developed World Index Presentation:

Contact us at index-team@euronext.com

Back to previous page | Euronext Index Data Page | Euronext Index Services