In 2023, we are re-starting the publication, each quarter, of the Euronext Commodities newsletter. It will contain information about new Euronext projects and changes, as well as news about the progress of the clearing migration and some interesting data.

On the market, the first quarter of 2023 was marked by the uncertainties around the renewal of the Black Sea Grains Corridor, the harsh competitiveness of Russian wheat, and the droughts in Argentina depleting corn and soybean production.

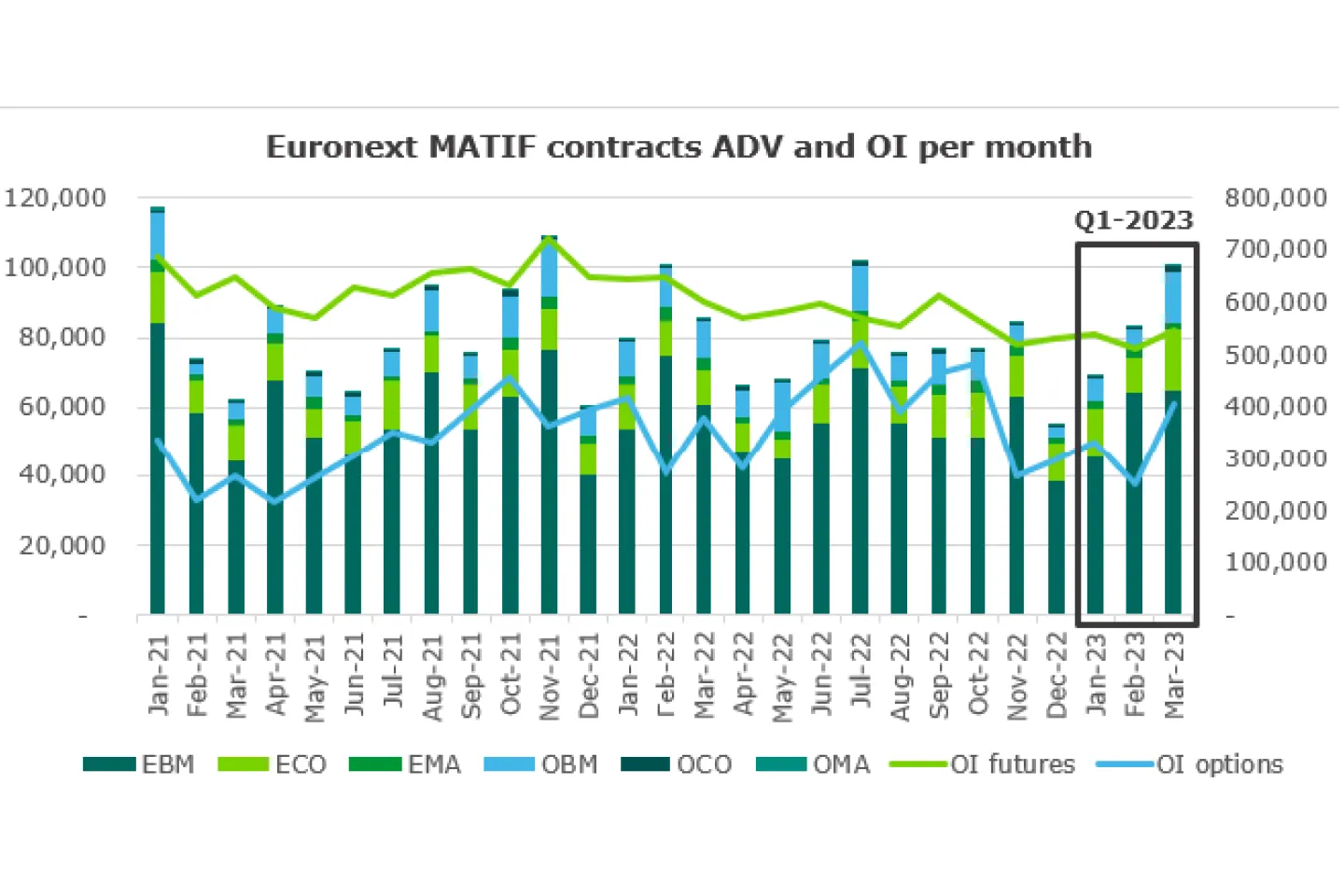

Since the beginning of the year, prices on Euronext MATIF contracts are following a bearish trend and went back to below €250/ton for wheat (EBM) and corn (EMA), and €450/ton for rapeseed (ECO), back to 2021 levels. Despite a calm activity in January and February, Q1-2023 remained +70% higher than Q1 five years ago. This is due to the March performance, which is our highest volume month since November 2021, led by Rapeseed Futures (+80% m/m) and Wheat Options (+150% m/m).

The Euronext Commodities team

Euronext MATIF contracts ADV and OI per month

Source: Euronext Group

One year of conflict between Ukraine and Russia

February marked the one-year anniversary of the beginning of the conflict between Ukraine and Russia. Indeed, on 24 February 2022, the war exploded on Ukrainian soil, triggering a series of unpredictable events on the global commodities markets, especially on grains. As a reminder, Ukraine represents 12% of global wheat exports, 20% of global corn exports and 50% of global sunflower seeds exports (a substitute for rapeseed). The country had to stop its grains exports from the Black Sea, which led to an imbalance between global supply and demand. Euronext MATIF contracts reached historic record-high prices, €450€/ton for wheat, €420/ton for corn and €1,094/ton for rapeseed.

Since August 2022, and the opening of the Black Sea Grain Corridor, flows from the Black Sea have been able to get back to an acceptable rhythm. Ukrainian grain and oilseed exports are now back to their 5-year average, which has reduced pressure on prices. Even if prices on Euronext MATIF contracts are now back to the level of 2021, some uncertainties remain at each renewal of the Black Sea Grain Corridor contract. The Corridor was extended on 18 March for at least 60 days.

Corn and Durum Wheat programme

The average daily traded volumes of our Corn Futures have increased by 62% between 2018 and 2022. This results from growth in volumes, liquidity and open interest over the last five years thanks to the strong interest of market participants and also to changes that came into effect at the end of 2019, including the introduction of Ghent (Belgium) and Dunkirk (France) as new delivery points.

To further support this contract in developing liquidity to the next level, we introduced an innovative fee scheme on 1 February 2023.

This trading fee scheme is based on the volume traded for each contract by a Euronext member over the billing month:

| Number of lots per month per member | Trading fee per lot |

|---|---|

| 0 - 14,999 | €0.28 |

| 15,000 - 19,999 | €0.13 |

| From 20,000 | €0.06 |

This fee scheme also applies for Durum Wheat Futures.

Moreover, we are launching a consultation about the Corn Futures contract (EMA). This will take place during May and June. If you are interested in taking part in the discussion, please contact us at commodities@euronext.com

Euronext Clearing migration

The Euronext teams are working actively on the set-up of a fully-integrated clearing house, Euronext Clearing. This integration will transform the trading landscape in Europe and strongly support the development of the Euronext MATIF franchise. We will provide further information such as detailed timelines and milestones, as well as go-live dates, in the coming weeks.

The Commodities team at events

Paris Grain Conference

In January, we were pleased to once again be silver sponsor of the Paris Grain Conference, an unmissable event where the French industry meets.

Euronext Annual Conference

Strengthening Europe’s leadership in the wheat market in times of global instability

On 7 March, the Euronext Annual Conference took place in Paris. During this event, we organised a roundtable on "Strengthening Europe’s leadership in the wheat market in times of global instability" with Jean-François Lépy, CEO of Soufflet Négoce by Invivo, Dominique Chargé, CEO of La Coopération de France, and Jean-Baptiste Clavel, Business Development Specialist at Crédit Agricole. The discussion was moderated by Anne-Laure Paumier, Director of International Affairs at Intercéréales. We would like to thank again the speakers and all those who attended the event.

Watch the replay of the full conference

The MATIF: meeting between the agricultural and the financial sectors

To coincide with the Euronext Annual Conference, CACEIS organised a workshop around "The MATIF: meeting between the agricultural and the financial sectors" with Jean-François Lépy from Soufflet Négoce by Invivo, Maxime Ecotière from Twenty First Capital, Cédric Renault from CACEIS and Elad Hertshten from Futures First. Nick Kennedy, Head of Commodities at Euronext was moderator.

Agro Paris Bourse

In mid-March, we took part in the traditional Agro Paris Bourse event, combined this year with the Intercéréales day. Thank you to those two important partners in the European grain industry, helping dialogue and exchange of information between leading players.

Find out more

See all our MATIF Commodities contracts on the Euronext Live Markets website.

Contact our team: commodities@euronext.com