In this month’s Equity Trading Newsletter, you will find equity product innovation updates as we plan to (1) launch dark trading and midpoint functionalities, and (2) expand our retail offering for pan-European and US stocks.

Highlights

Euronext will launch dark, midpoint and dark-lit sweep functionalities on its Central Order Book: a full suite of dark limit orders, peg to midpoint and sweep functionalities for Dark to Lit interactions at 10x lower latency than MTFs.

Euronext will expand its retail offering on the Global Equity Market (GEM) and Trading After Hours (TAH): over 300 pan-European and US shares will be available for trading until 20:30 CET, cleared and settled in Euros, with the same market microstructure and connectivity as Euronext main markets.

1. Dark trading and midpoint functionalities

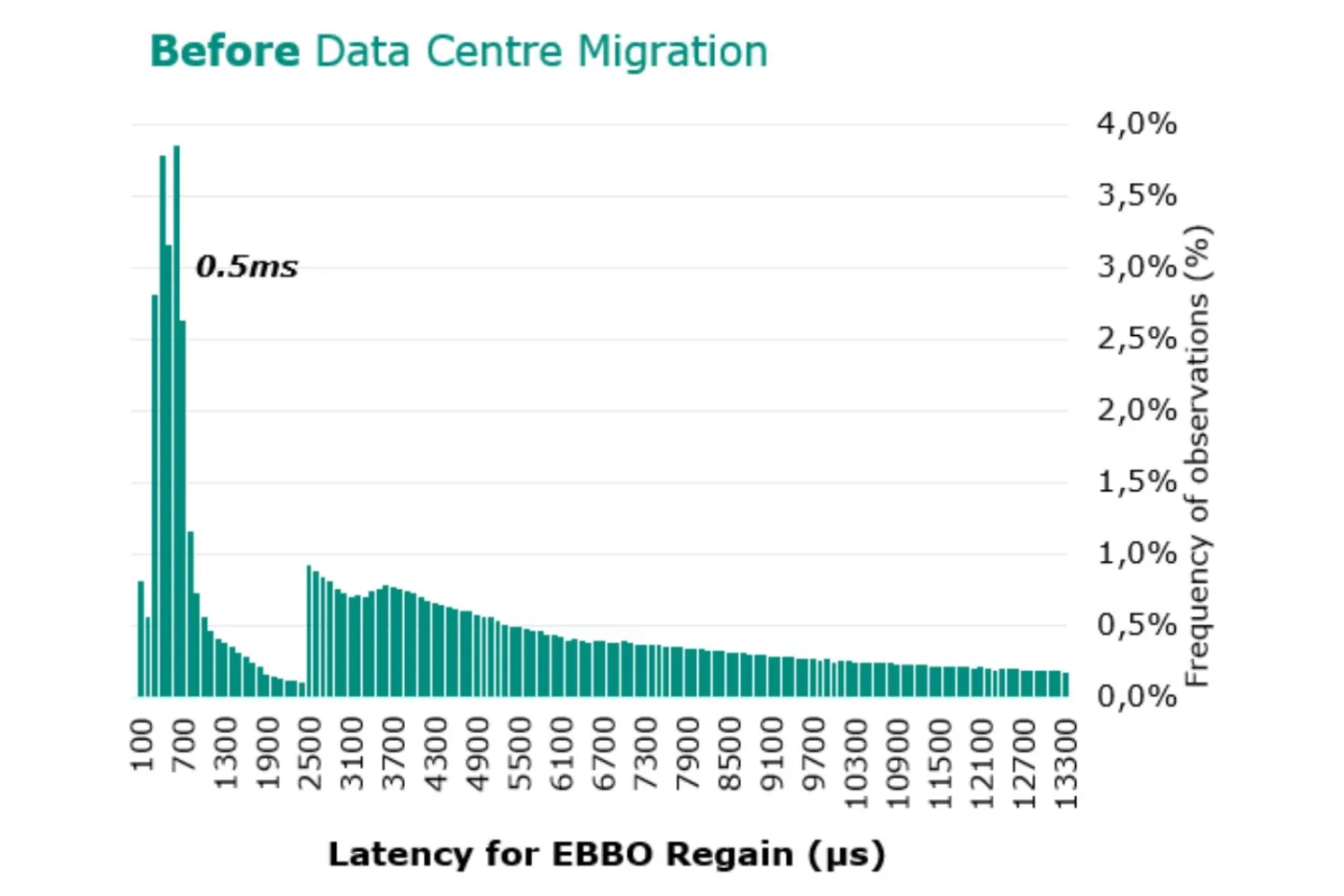

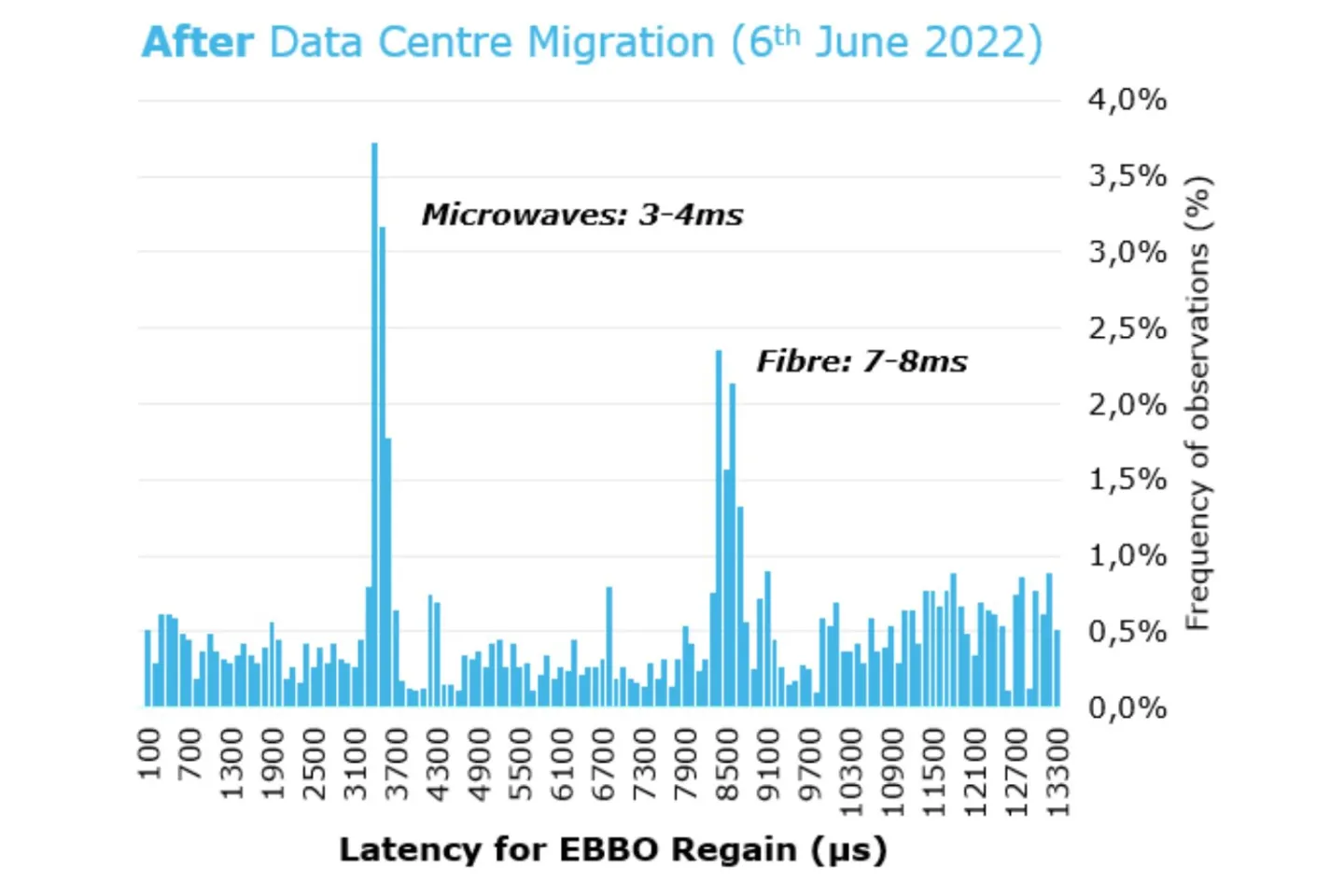

- The latency between Euronext and London MTFs has multiplied by ~10 since the migration of Euronext Data Centre from Basildon (UK) to Bergamo (Italy), thus Dark to Lit execution performance is deteriorating on MTFs

- Euronext will launch dark functionalities allowing participants to source liquidity in both pools (Dark and Lit) within the Central Order Book – at no latency

- Focus is mainly on execution below Large-In-Scale since two thirds of dark trading in Europe occurs below LIS threshold

- Full suite of functionalities: Limit orders / Peg to Midpoint / Sweep functionalities for Dark to Lit interactions / Minimum Quantity and Size thresholds (MAQ & MES)

- Limited market impact on orders executed on the dark book and, thanks to the sweep functionalities, orders can be transferred to the Euronext Lit CLOB with no latency in case of partial or no execution in the dark

- Expected timeline for the launch is Q4 2023, and in the meantime we welcome your thoughts on the full design of functionalities and the technical implementation.

Data source: big xyt

|

Focus on latency:

|

Data source: big xyt – EBBO regain dashboard

2. Pan-European and US stocks on Euronext GEM

- Euronext Global Equity Market (GEM) and Trading After Hours (TAH) are up and running MTFs already managed by the Euronext Group

- Dedicated retail offering with 100+ EU and US blue-chips available

- Trading until 20:30 CET overlapping with US markets hours

- Same connectivity, microstructure, market surveillance as Euronext main markets – and already migrated onto Euronext's Optiq platform on 27 March 2023

- 40+ members connected: local retail banks, global brokers and market makers

- A full revamp of the market will occur in Q3 2023, with a dedicated market making scheme to boost liquidity and an expanded stock universe.

Country of reference market Number instruments on GEM and TAH today Number instruments on GEM and TAH "tomorrow" US 26 200+ Germany 34 100+ Spain 6 30+ Finland 1 10+ Sweden - 20+ Austria - 10+ Euronext countries 32 Euronext blue chips for Trading After Hours

The Euronext Equities team

In the news

The TRADE News - 16 May 2023

Euronext to launch dark trading and expanded retail trading services amid second best quarterly results in its history

New dark offering is aimed at reducing latency arbitrage for clients following the exchange’s data centre migration, Euronext’s Simon Gallagher and Vincent Boquillon told The TRADE.

Read the article

At the FIX Nordic Trading Conference

We were delighted to catch up with our Nordic members in Stockholm last week, and we look forward to continuing to strengthen our products and services offering in the region.

For more information

Don't hesitate to contact your sales representatives with any queries or feedback.

Thank you!

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided "as is" without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext's subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext.

Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at www.euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.

Euronext NV | Beursplein 5, 1012 JW Amsterdam