Factual insights on Euronext being the market where price formation happens.

We also provide observations on Closing Auctions activity, evolution of European equity volumes since 2021 with recent spikes over March, Euronext displaying the tightest spreads for Italian blue-chips, and discussions on the MiFIR Review.

Simon Gallagher, Head of Cash and Derivatives, Euronext

Highlights

-

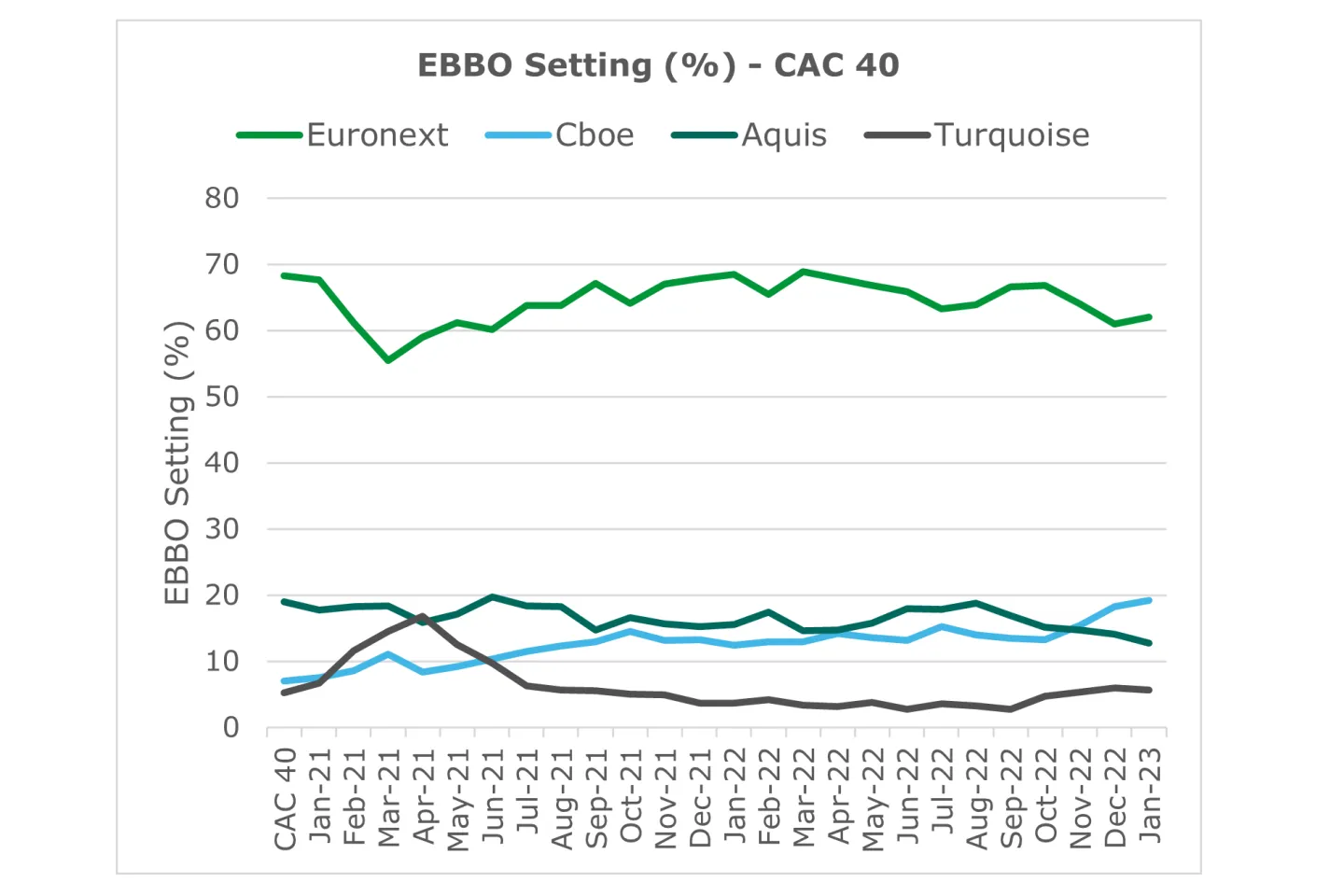

EBBO Setting: Euronext is the venue where price formation happens with 62% EBBO Setting for CAC 40 and AEX stocks in February – at least 3 times higher than MTFs.

-

Trading at the Closing Auction: Euronext’s Head of Quant Research Paul Besson joined The TRADE’s Roundtable on Closing Auctions with Buy-side and Sell-side firms to discuss drivers, explicit/implicit costs, and impacts of growing volumes at the Close.

-

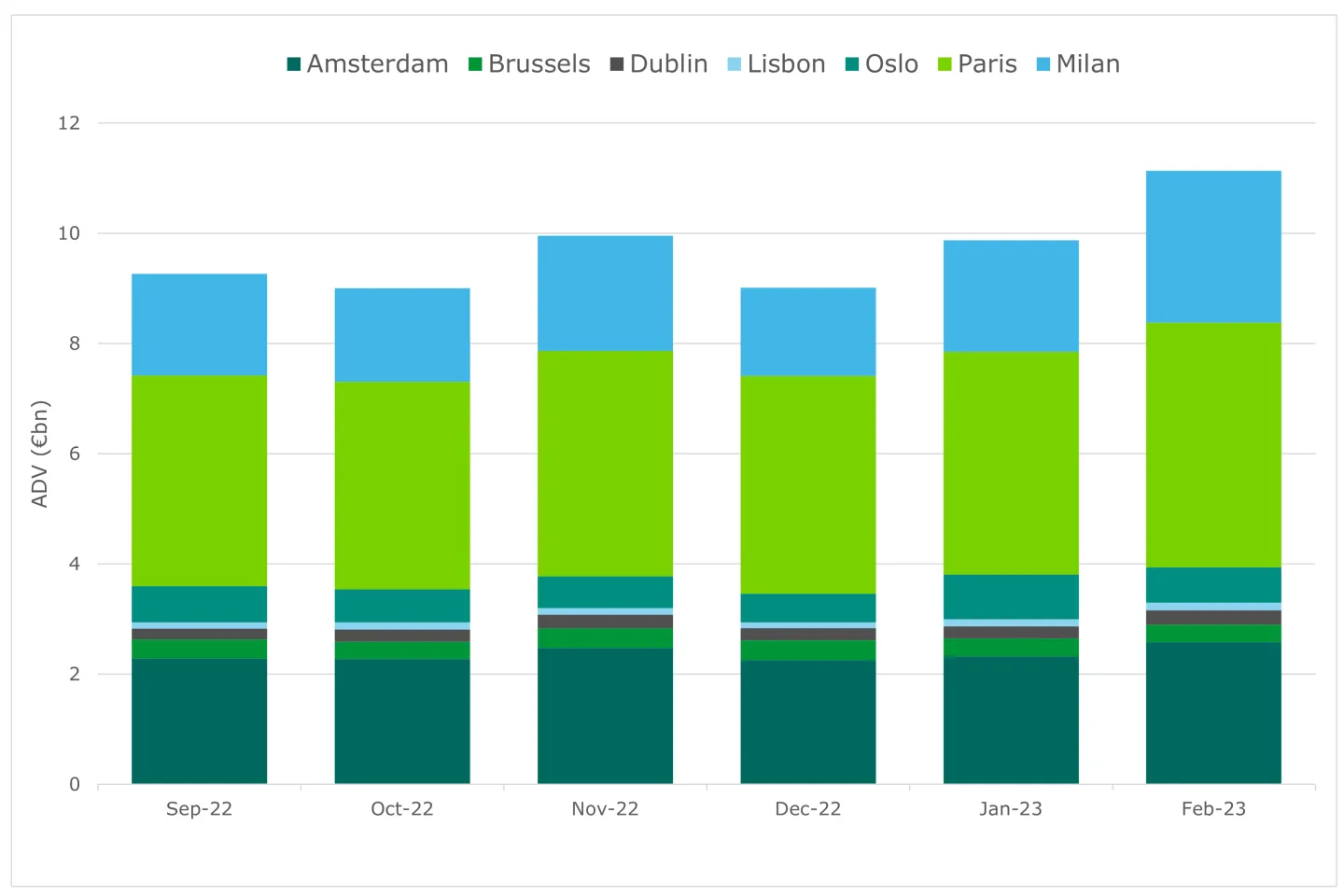

Equity volumes: Euronext is the largest exchange in Europe by Average Daily Value (ADV) traded for lit equities on-book, with €11.1bn ADV in February 2023. This is the highest monthly turnover since March 2022, and March 2023 is now experiencing significant spikes (€18.9bn on 15 March).

-

Average Spread on Milan blue-chips: Euronext displays lower spreads than MTFs, both at Touch (4.8 bps) and at Depth (5.5bps at 10K, 6.4bps at 25K).

-

Market structure and Regulation: Simon Gallagher, Head of Cash and Derivatives at Euronext, highlighted the relevance of regulatory scrutiny for Systematic Internalisers (SIs) and Payment for Order Flow (PFOF) in an article in The TRADE.

Topic of the month:

EBBO Setting and price formation

Euronext displays significantly higher EBBO Setting (%) than MTFs – meaning Euronext is the venue of price formation for the seven equity marketplaces we operate.

| EBBO Setting (%) in February 2023 |

Euronext | CBOE | Aquis | Turquoise |

|---|---|---|---|---|

| CAC 40 Stocks | 62% | 19.2% | 12.7% | 5.5% |

| AEX Stocks | 62% | 17.2% | 15.5% | 4.9% |

Data source: BMLL Technologies

Roundtable on Closing Auctions

Listen to the Roundtable in four parts on Closing Auctions organised by The TRADE News where Euronext’s Head of Quant Research Paul Besson and other experts at Sell-Side and Buy-Side firms discuss.

Click on the four links below to watch the video:

- The key drivers of growth for rising volumes at the Close

- Implicit and explicit costs for trading at the Close in comparison with Continuous trading

- Impacts of the migration to the Close on the Continuous trading day

- How institutional investors can navigate these liquidity patterns

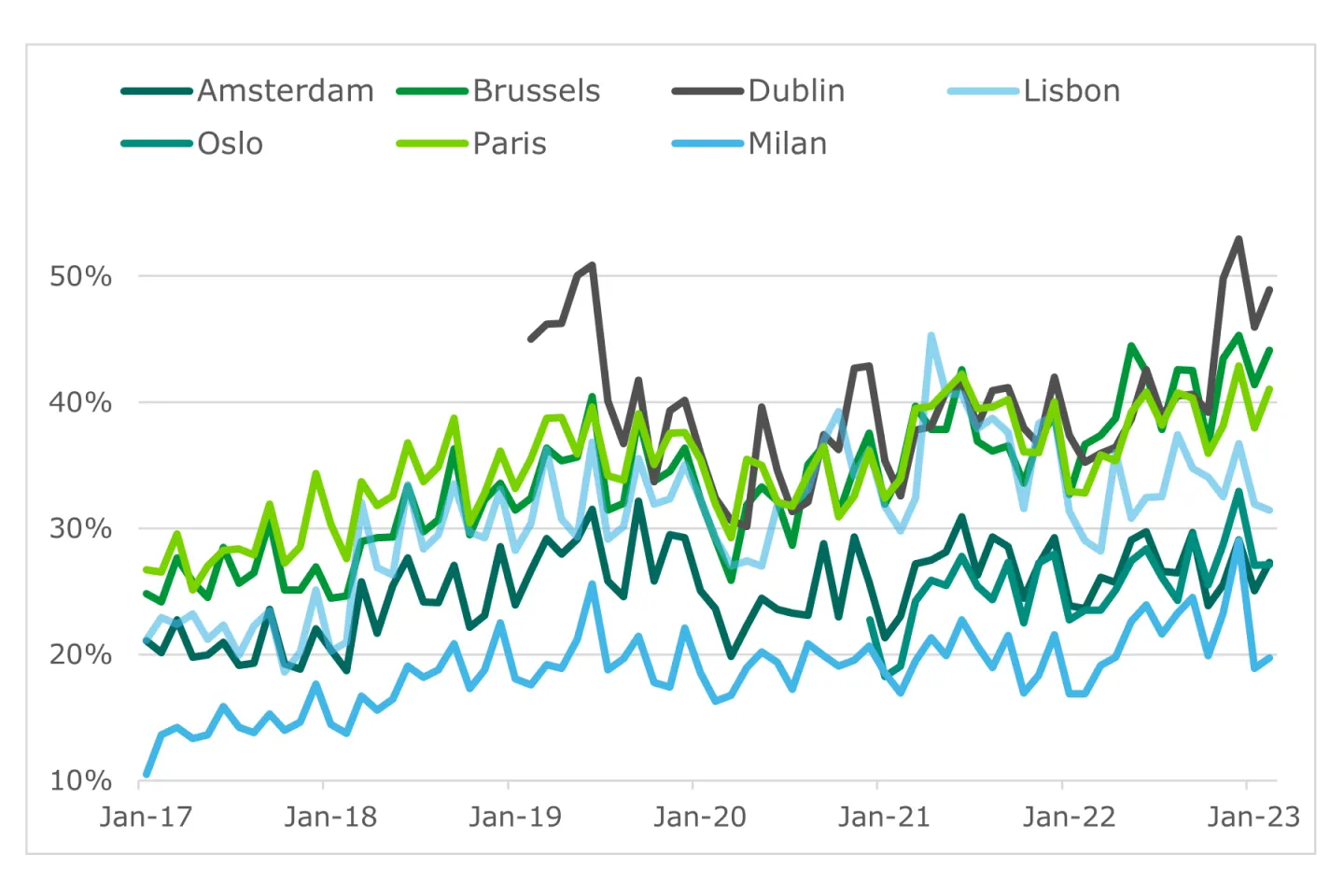

Auction volumes in percentage of total turnover across Euronext markets

Data source: Euronext Group

The Euronext Quantitative Research team published a research study back in 2021 highlighting the benefits of trading at the Close. It showed that for a given trade size, the resulting market impact during Closing Auctions is 2-3x smaller than it is for Continuous trading, as the Close represents the most liquid event in equity markets.

Feel free to request your copy of the report at QuantReports@euronext.com

Equity volumes update

Euronext is the largest exchange in Europe by Average Daily Value (ADV) traded on lit equities with €11.1bn ADV in February 2023 - the highest level since March 2022.

Furthermore, the equity market is experiencing significant volumes spikes in March, with €18.9bn traded on 15 March – the trading day with highest turnover in 2023 YTD.

Euronext Equity trading ADV (€bn) per country

Data source: Euronext Group and IRESS Market Data

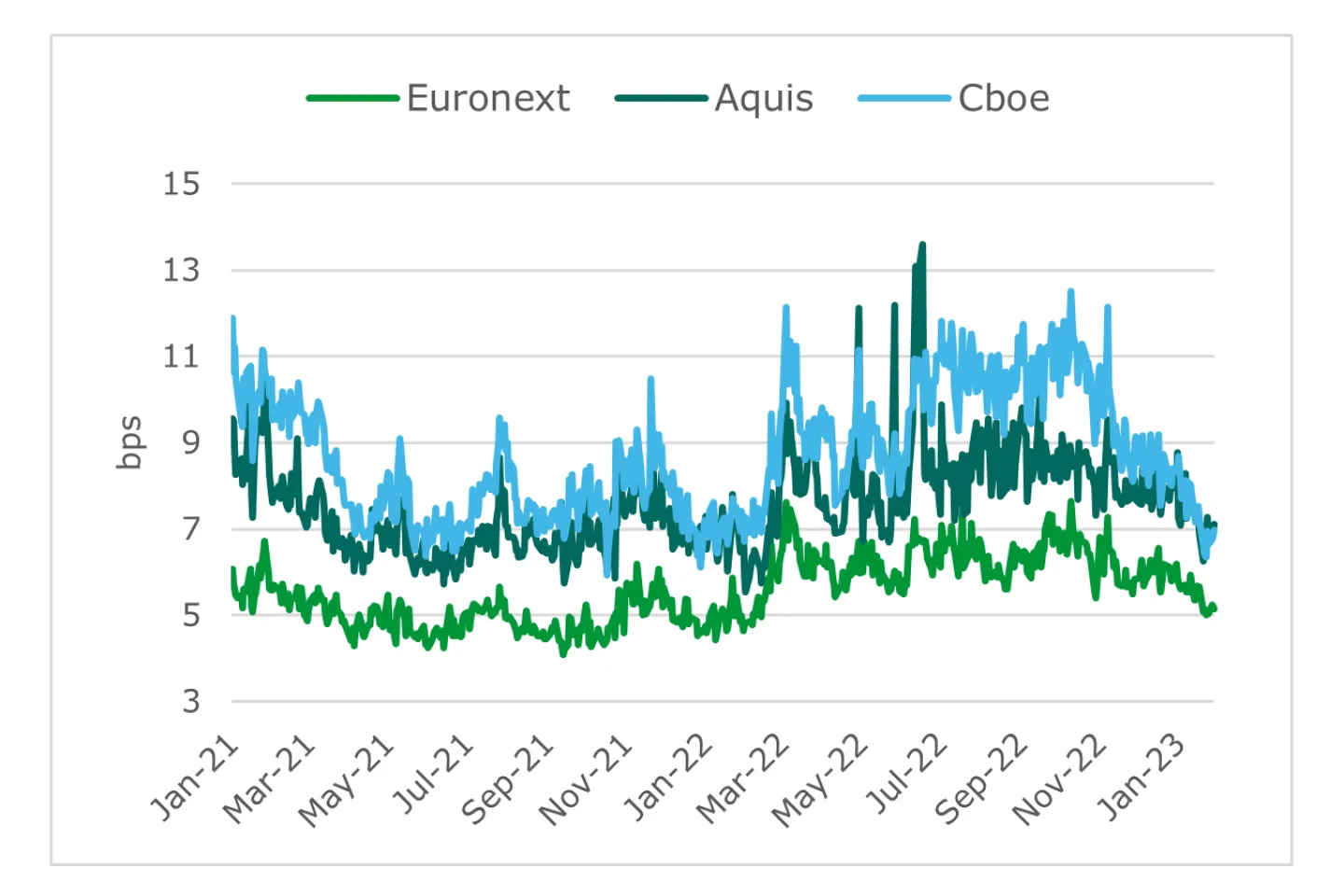

Market quality: average spread of Milan blue-chips

Euronext displays the lowest spreads on Milan blue-chips compared to MTFs – both for Spread at Touch (4.8 bps) and for Spread at Depth (5.5 bps at 10K depth; 6.4 bps at 25K depth).

| JAN 2023 | Euronext | Aquis | CBOE | Turquoise |

|---|---|---|---|---|

| Spread at Touch | 4.8 | 5.9 | 5.1 | 15.0 |

| Spread at Depth (10K) | 5.5 | 7.3 | 7.4 | 30.0 |

| Spread at Depth (25K) | 6.4 | 11.2 | 10.8 | 48.7 |

Spread at 10K Depth (in bps)*: Euronext better than Aquis and Cboe

Data source: big xyt. Volume-Weighted Average Spread (VWAS) for 40 Milan blue-chips.

*Turquoise is not displayed in the chart.

Focus on Market structure and Regulation

As reported in The TRADE by Simon Gallagher, Euronext Head of Cash and Derivatives.

The City is defining the rules of Continental Europe more than ever post-Brexit

“The paradox behind the whole MiFIR Review is that the weight of the FCA and the City of London in European regulation has never been greater...

If regulators accept that Systematic Internalisers will form a material feature of the European execution landscape, then they should be regulated in a manner that reflects their scale, with reinforced transparency obligations and improved reporting on the nature of the trades that occur inside them.

The FCA has clear rules on Payment for Order Flow (PFOF) and we’re aligned with their view, whereas in Germany there is a toleration of the practice. As a pan-European operator, this lack of a joined-up, coherent vision of the markets is frustrating for us.

Euronext Equities team at events in March

AFME Equities Dinner

9 March - The Savoy, London

Euronext sponsored the AFME Equities Dinner and was delighted to meet with honourable peers of the Equities industry during this annual tradition.

FIX Trading EMEA Conference

9 March - Old Billingsgate, London

On the panel ‘The Price of Liquidity in Equities’, Paul Besson pointed out that, in addition to the explicit trading fee, Markouts must be taken into account. Investors compare net trade prices versus the EBBO after the trade has happened; therefore, only looking at explicit fees is often misleading, as the rebate-paying venues also display the worst Markouts.

FIA Forum

9 March - Nasdaq, Stockholm

Italy Secondary Markets Update

13 March - Borsa Italiana, Milan

This Euronext conference was hosted in Milan with the local capital markets ecosystem, welcoming over 80 participants, and was the opportunity to share the framework of Euronext’s local and global initiatives across the value chain, amid the fast-changing landscape for Italian and European equity markets.

A variety of our experts discussed the evolution of trading (Massimo Giorgini) and clearing (Cristina Belloni) landscapes, Euronext’s superior equity market quality (Paul Besson), retail investors market structure (Roland Prevot) as well as the ongoing MIFIR review (Samantha Page).

Rosenblatt European Market Structure Conference

30 March - Royal Society of Chemistry, London

Listen to the keynote speech of Stéphane Boujnah and the panel with Simon Gallagher, and get in touch with Vincent Boquillon and Niall Gibney to meet up at the event.

Check out our latest insights on LinkedIn

Click on the links below:

The TRADE Roundtable: Trading at the Closing Auction

'The Price of Liquidity in Equities' panel at FIX EMEA 2023

For more information

Do not hesitate to share with your sales representatives

any feedback or question that you might have.

Thank you!

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided "as is" without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext's subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext.

Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at www.euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.

Euronext NV | Beursplein 5, 1012 JW Amsterdam