Despite the focus on waste-based fuels, upcoming plans for renewable diesel and sustainable aviation fuels will re-write oilseed supply and demand and drive change across global trade flows. That means new risk management tools are vital.

The prevailing narrative for oilseeds in recent years has focused heavily on the outlook for biofuels - a reflection of a ramp up in new, sophisticated production capacity and a reaffirmation of government commitments to driving the adoption of a new generation of renewable fuels.

The bulk of the excitement has fallen on the oilseeds complex this time, as technologies pioneered by a handful of early adopters began to seep into a wider industrial base and deliver a substantial upswing in capacity.

Key to that has been the arrival of fuels that attain the hallowed ‘drop-in’ status - in performance terms, indistinguishable from crude oil-based diesels and even, in some cases, outperforming their mineral oil equivalents.

The European sector has arguably been more familiar with these fuels - known as hydrotreated vegetable oils (HVO), but it is the US that is emerging as the driving force where they are known as ‘renewable diesel’.

A (sustainably-fueled) bandwagon has gained momentum in recent years, driven in part by the incentives and initiatives unveiled in President Joe Biden’s Inflation Reduction Act, attracting new investment, new capacity and a reshuffling of trade flows.

But with economies being where they are, and a barrage of challenges still for markets to negotiate, the first major challenges have already brought fears that the renewable diesel card has been overplayed.

A low-key announcement from Cargill in June confirmed that it had postponed investment in a new soybean processing facility proposed for the Missouri banks of the Mississippi River, and spawned headlines declaring the renewable diesel bubble had burst.

Should we really have been surprised by that?

The announcement was rapidly followed by fundamental forces that pulled the oilseed complex in opposing directions – at one point sending soybean contracts to limit up amid fears over weather, while soyoil contracts hit limit down amid fears over biofuel mandates.

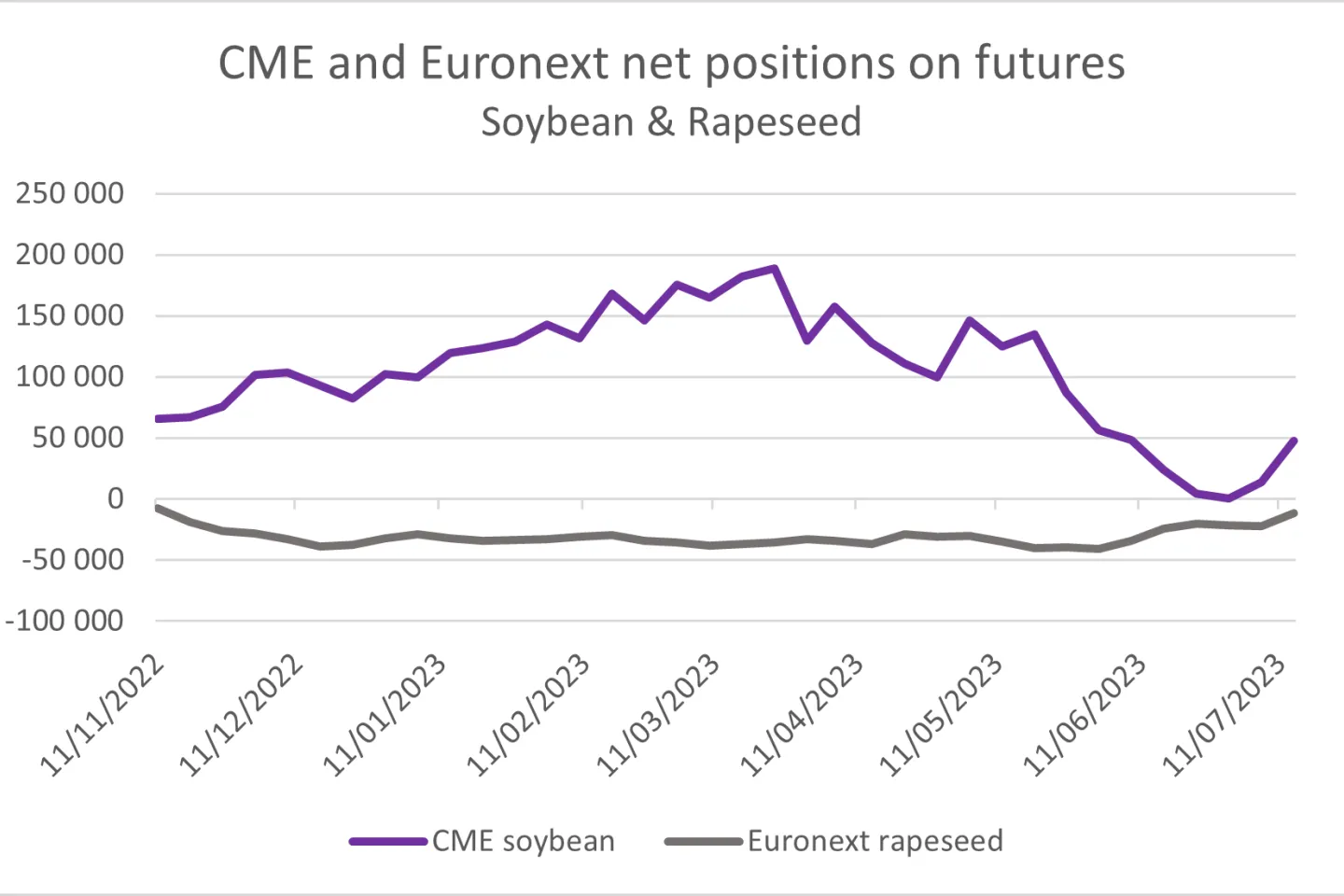

Investors clearly responded to the move, Chicago soybean contracts coming close to turning net short as speculators braced for price falls, while paradoxically the prevailing Euronext rapeseed contract net short moved into slightly shallower waters.

If Cargill’s decision was the bubble bursting, then a decision from the US Environmental Protection Agency (EPA) delivered another more substantive blow.

Charged with overseeing US biofuel mandates and policies, an end-December announcement of EPA thinking for the critical 2023, 2024 and 2025 blending volumes had already been met with dismay from US biofuel producers when it appeared.

Far from factoring in the new biodiesel and advanced biofuel production capacity either online, coming online or still proposed, EPA seemed to have offered relatively modest increases in the three years ahead.

Paradoxically, that fostered hopes that when the agency did confirm its final thinking ahead of its agreed deadline of June 14, it would have rethought its figures and come up with some magic increase.

After an additional week’s delay, seemingly negotiated between EPA and biofuel industry group, Growth Energy, the final rule for the renewable volume obligation succeeded only in underwhelming producers yet again.

Should we have been surprised?

The US has always been long diesels - resulting in a mutually rewarding trans-Atlantic exchange that underpinned refining models for much of the last seventy years.

European refiners, typically long gasoline, built a model that allowed for the export of the road fuel to the US, while the US dispatched excess middle distillates back to Europe in return.

With Europe the great diesel short, the ramp up in new US renewable diesel capacity could have provided an echo of that trade flow, but as the industry piled in on the back of new incentives, the investment in capacity inevitably began an erosion of margins and a smaller return for the later adopters.

Fastmarkets The Jacobsen had already been factoring the slowdown into their capacity outlooks and forecasts, but does it really amount to a bubble bursting?

Renewable diesel has had its challenges, not least the wholesale abandoning of diesel powertrains among many car manufacturers as the engine type gets squeezed out by full electric and hybrid electric vehicles.

Add to that the lingering fears of NOx emissions, the loitering shadow of the Volkswagen diesel emissions scandal and an unwillingness among European governments to continue to favour the fuel through preferential tax rates means the fall from grace has been swift.

Data from the European car makers’ association ACEA shows nearly 37% of all new car sales across the bloc were diesel in 2018 – already in decline from heady days when in some countries well over 80% of new cars were diesel.

By 2022 that had slid to 16.4% and was running at 14.5% to date in 2023.

That shouldn’t underestimate the latent potential that renewable diesel still carries – there remains a significant diesel-reliant haulage, industrial, train and car-based demand, but the trump card that remains to be fully realised is the impact that sustainable aviation fuel mandates are likely to bring to fats and oils.

Take off

Aviation remains the key white elephant in decarbonization terms – a mode of transport that only works through the application of raw power in a harsh environment that biofuels have struggled to break into.

But with electrification unsuited to commercial long haul aviation, biofuels are the last option standing to deliver rapid decarbonization, and the ‘drop-in’ nature of fuels is the only game in town.

“These guys are in it for the long term… they’re looking at ten, twenty years ahead and they don’t really care about the short term,” one biofuel analyst told us.

The risk here is not that the bubble is overstated and prone to bursting… the risk lies more in whether the ambitious targets are even remotely feasible, and what impact even trying to meet these targets will have on plantings, balances and trade flows.

Both the US and the European Union have set out their expectations on sustainable aviation fuel (SAF) and the scale of the mandates are almost unimaginable.

For the US, the USDA’s outlook forum back in February 2023 resulted in predictions that SAF demand could reach 35 billion gallons by 2050.

Putting that in perspective, currently the US produces less than half that volume of ethanol - 15 billion gallons per year and uses over 10% of the entire world’s supply of corn to do that.

That is the result of a similar concerted, incentivised effort to tackle security of gasoline supply and meet early sustainability requirements, and a similar change is already unfolding in fats and oils.

The US Energy Information Administration holds data on feedstock usage showing the use of animal fats and grease has increased 38% between the first five months of 2023 and the same period of 2022, with use of soyoil, rapeseed oil and corn oil all on the rise over the period.

And, while biodiesel production has plateaued in recent months – itself a minor recovery after several months of consecutive declines – operable renewable diesel capacity leapt 15% between December 2022 and March 2023, according to EIA data.

In isolation, the scale of the challenge is already clear just within a US context, but Europe is also setting out on a similarly ambitious plan to drive adoption of SAF fuels by legislating for a massive ramp up in use by 2050.

As of 2020, some 0.03% of European aviation fuel supply was classified as sustainable according to EU data, with the bloc’s governing body aspiring to ramp that up to 70% by 2050 - introducing a degree of uncertainty to the equation, as demand for air travel recovers after the pandemic.

With electric vehicles leading a clear pathway towards decarbonisation of the car fleet, the ambitious nature of the plans reflects the growing acknowledgement that other modes of transportation now lag the EV progress.

There’s no precedent for such a dramatic change in the make up of fuel supply - and the consequences for the feedstock slate will be profound, even if the mandates are not met.

The EU’s plans are further complicated by a stated expectation that the feedstock cannot be food-based, potentially ruling out much of the oilseed complex, but firing huge interest in waste-based fats and used cooking oils.

Collectively, the waste-based feedstock slate alone is unlikely to meet the EU’s 70% target - particularly with stiff competition for the feedstocks set to come from the US and other countries.

Those overreaching ambitions coupled with major questions on the scarcity of feedstocks to attain these goals means that any industry pain is likely to be short-lived – and will reinvigorate interest for derivative tools that will manage the shift in risk profiles.

“Right now, there’s excess capacity in the system for sure, but if they have to run at a negative margin they will because they know they will be the last man standing,” the analyst said.

Written by Tim Worledge, Fastmarkets

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at https://www.euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.