With roots stretching back to the 16th century and 1,850+ listed companies, Euronext markets are the largest, best integrated and trusted capital markets in Europe. We offer cost-effective capital raising opportunities, from equity to bonds capital markets.

Proven capital-raising opportunities

Equity

Listing your company on Euronext markets gives you the funds to finance your future growth, provides liquidity to existing shareholders, and increases your global profile.

How we support

Bonds

Issue bonds securities through Euronext markets to gain access to one of the most secure and orderly secondary trading markets in the world. From sovereign and municipal bonds to corporate and ESG bonds, we ensure an efficient listing process and competitive listing fees for issuers across industries and jurisdictions.

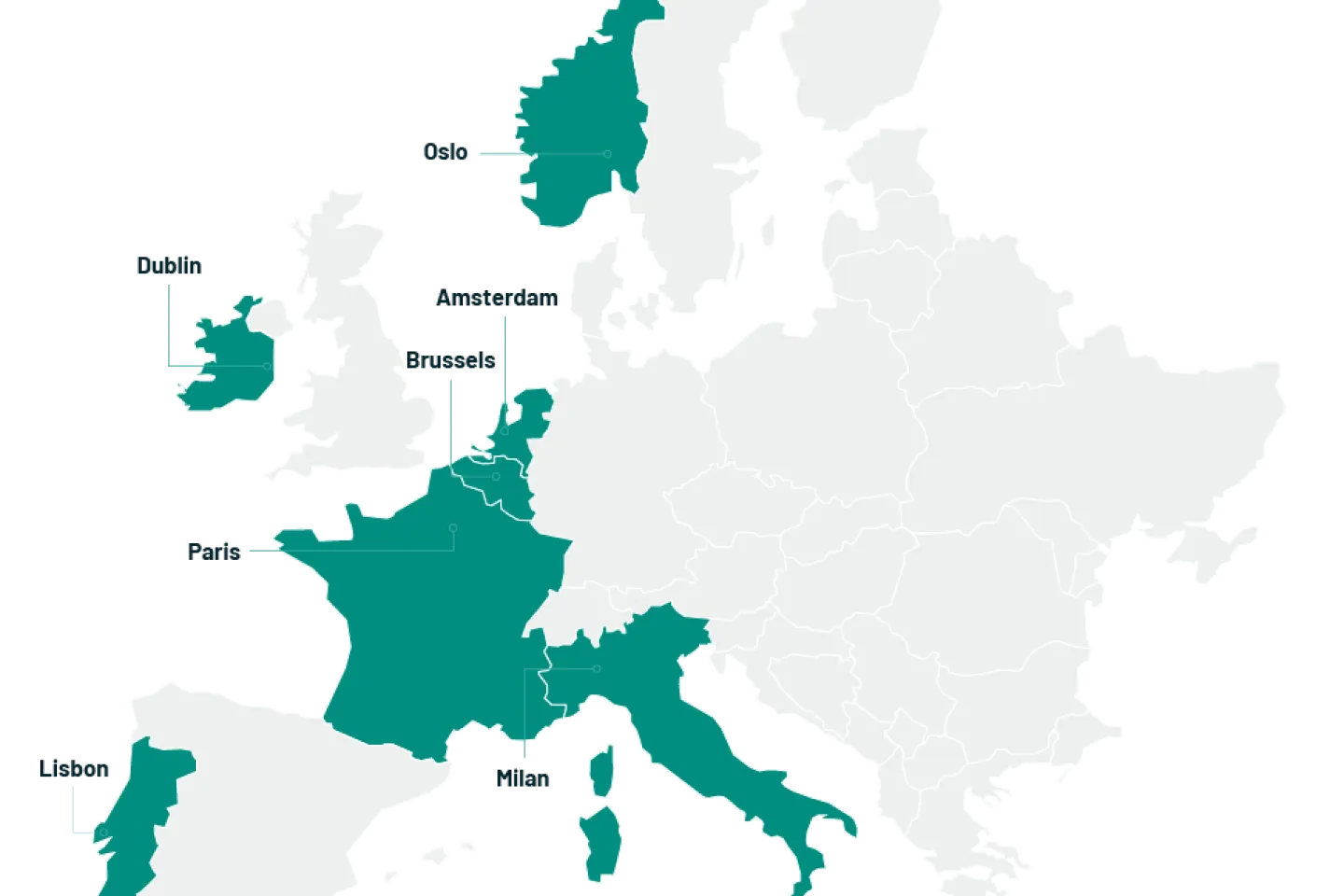

Euronext markets as of January 2024

Support across sectors and sizes

We have markets designed to suit every company regardless of sectors, size or location.

Find out which market is right for you

Are you looking to take your business public?

IPOready, Euronext’s pre-IPO training programme for company executives, can help you get there!

Our 6-month educational programme is designed to provide executives with the tools and insights they need to achieve IPO readiness and success while focusing on building a strong European community of alumni to provide ongoing support and guidance between peers.

The content is provided by Euronext and its extensive network of partners and sponsors from the financial industry: investment bankers, auditors, lawyers, financial communication, and investor relations experts.

IPO preparation process: best practices in ESG reporting (in French)

A practical guide to ESG reporting for companies preparing for an IPO - In partnership with L'Institut de la Finance Durable.

Latest Press Releases

CVC Capital Partners lists on Euronext Amsterdam

€250 million raised Market capitalisation of €14 billion and increase in offer size to €2.0…

Amsterdam

Planisware lists on Euronext Paris and joins the Euronext Tech Leaders segment

Market capitalisation of €1.1 billion Global Offering of €241 million, which could potentially…

Paris

Euronext announces volumes for March 2024

Amsterdam, Brussels, Dublin, Lisbon, Milan, Oslo and Paris – 8 April 2024 – Euronext, the leading…