Benoît van den Hove to succeed Vincent Van Dessel as CEO of Euronext Brussels

Euronext MATIF commodities franchise: growing options volume amid high volatility in 2022

Volatility in commodities markets

Volatility in the commodities markets surged significantly in 2022. This was mainly due to the invasion of Ukraine by Russia in February 2022, and to increased consumption following years of Covid.

The grains and oilseed markets were at the centre of this storm, which was exacerbated by unfavourable weather conditions in some producing areas.

Increased volatility in the grain markets prompted all participants along the value chain, in particular producers, end users and transformers, to seek efficient tools to manage their price risk in order to lock in margins and insure sustainability of their business.

Growing volume Euronext MATIF

This trend has been reflected in growing volume across Euronext MATIF considered as a very useful tool for market players across the world to lay out the price over last years.

The Euronext MATIF grains franchise has grown significantly over the last five years, with volumes increasing by 40%.

Liquidity has continued to build in the milling wheat contract, which has become a global benchmark.

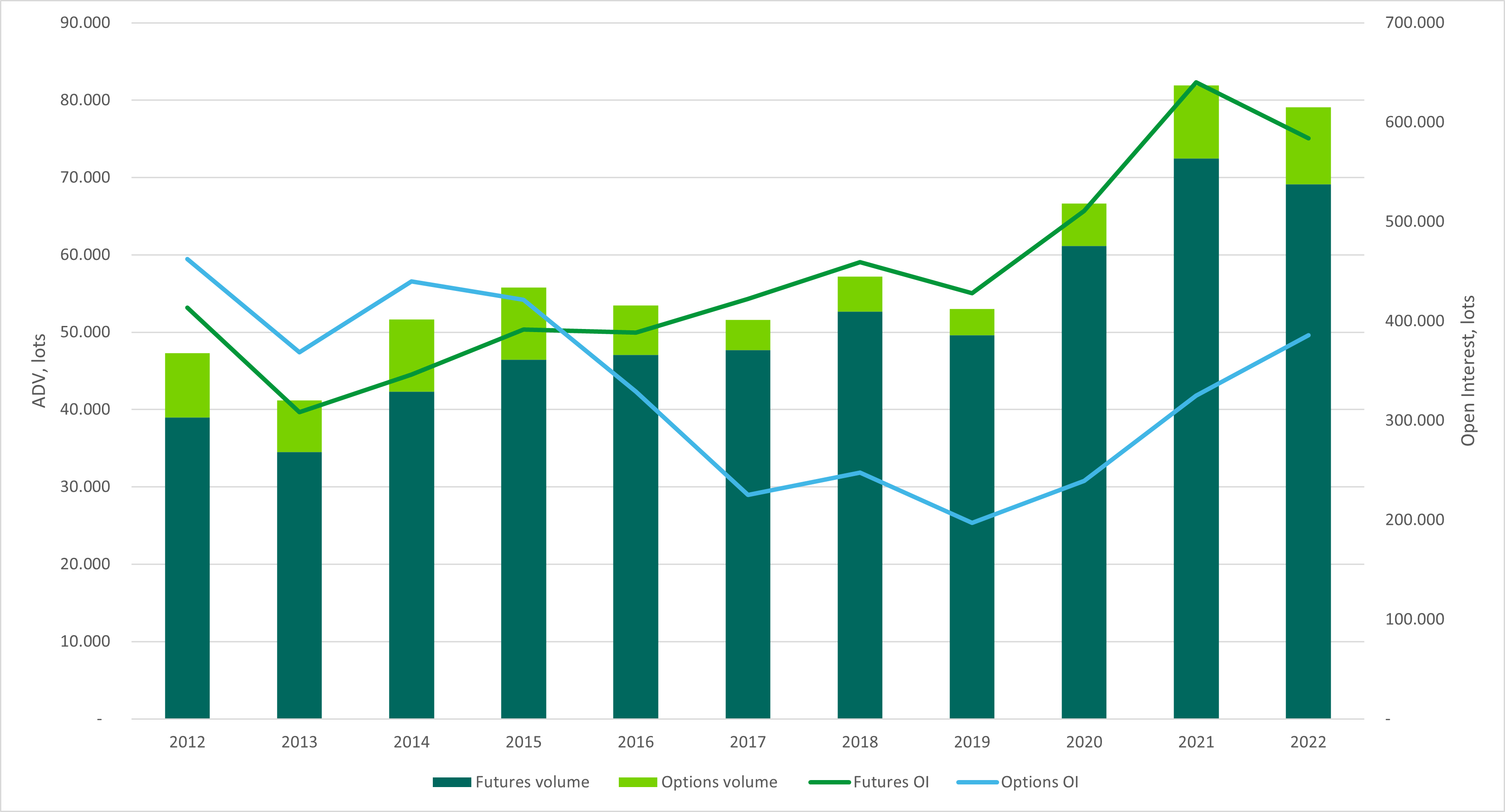

Euronext Milling Wheat, Rapeseed and Corn Futures & Options

Average Daily Volumes and Open Interest

Source: Euronext Group

Options have become an attractive hedging tool over futures over last few years following increased volatility in the markets leading to higher margin requirements by clearing houses.

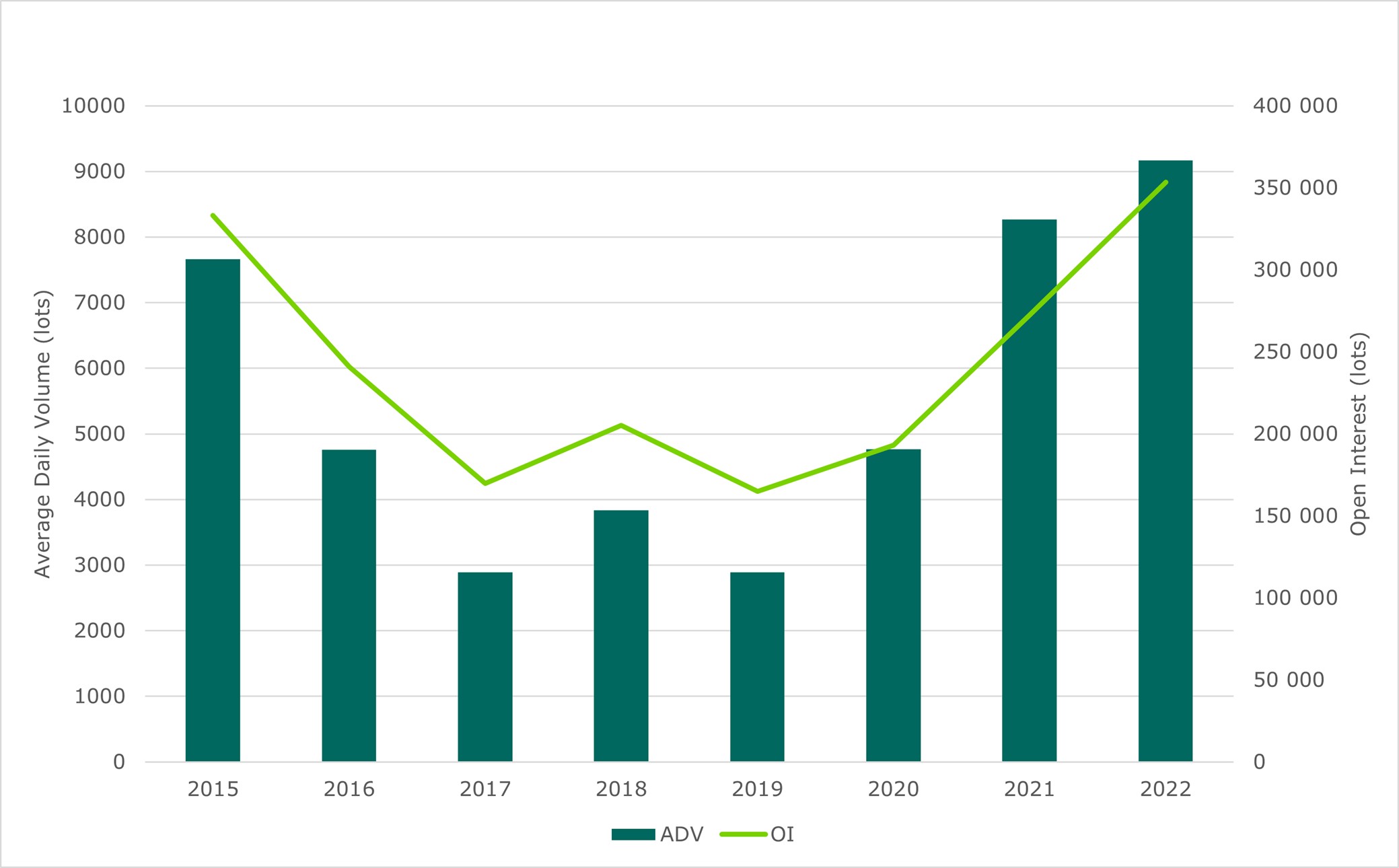

Milling Wheat Options exceeded an average volume of 9,000 lots per day in 2022:

Euronext Milling Wheat Options (OBM)

Average Daily Volume and Open Interest

Source: Euronext Group

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided by a third party unaffiliated with Euronext, the content therein is not provided or controlled by Euronext nor does it constitute Euronext’s opinion. This publication is provided “as is” without representation or warranty of any kind. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in the party that provided this publication. No part of it may be redistributed or reproduced in any form without the prior written permission of this party.

Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.

MIB ESG Index

The national ESG blue-chip index dedicated to the Italian market.

Serving as the new ESG index reference in Italy

The MIB® ESG Index is designed to identify the 40 highest ranking companies in Italy which demonstrate the best ESG (Environmental, Social and Governance) practices.

Combining an Italian footprint with global reach, this index is built with a local focus in mind and created in partnership with Borsa Italiana.

After a large consultation with the Italian players, a methodology with globally recognised standards was created for the Italian market to serve as the new national ESG reference.

MIB ESG index key principles

The index’s methodology reflects a ranking of the top 40 Italian listed companies based on ESG criteria. The selection is made from the 60 most liquid Italian companies and excludes companies involved in controversial activities. Components of the index are free-float market capitalisation weighted.

The index methodology also includes exclusions filters with regards to the following Global Standards:

- United Nations Global Compact principles (UNGC)

- Guidelines for Multinational Enterprises (OECD)

- ILO Conventions

The MIB ESG offers opportunities for the creation of a wide range of investment vehicles such as ETFs and funds.

Learn more about MIB ESG:

MIB ESG Index Rules | MIB ESG Factsheet

MIB ESG Report | MIB ESG Moody's ESG Report

Watch the presentation:

Euronext ESG Blue-chip indices

The MIB® ESG index is a key component in a broader suite of flagship ESG indices across the Euronext geographies.

Discover more Euronext esg blue-chip Indices

Contact us at index-team@euronext.com for any queries.

Back to previous page | Euronext Index Data Page | Euronext Index Services

Euronext launches the BEL® ESG index

Euronext Corporate Services’ IntegrityLog supports greater protection for whistleblowers in Austria

Otovo transfers to the Oslo Børs main market

Lepermislibre lists on Euronext Growth Paris

Euronext Securities and J.P. Morgan successfully complete migration to direct market access

J.P. Morgan’s international investors get access to Danish capital market

J.P. Morgan is now a direct participant in Euronext Securities Copenhagen and providing international investors a more direct and efficient access to the 1.5 trillion euros in assets in the Danish capital market.

Danish capital market accessible for J.P. Morgan’s international investors

Anthony Attia, Global Head of Primary Markets and Post-Trade at Euronext, commented on the successful migration:

We’re pleased to support J.P. Morgan in their efforts to strengthen and grow their business across the Nordic region. Our extensive presence throughout Europe and our network of CSDs in the Nordics, Italy and Portugal put us in an ideal position to help international players access in the whole value chain across multiple markets.

Euronext Securities Copenhagen and J.P. Morgan signed an agreement to become a direct participant in the Danish market in July 2022. Since that time, teams at Euronext Securities Copenhagen and J.P. Morgan have worked closely together to migrate the global financial services firm to a direct membership in the CSD. After a series of well-controlled tests, the teams successfully migrated J.P. Morgan’s portfolios across four tranches on to Euronext Securities Copenhagen’s platform.

Hannah Elson, Global Head of Custody at J.P. Morgan also commented:

We thank Euronext Securities for the continued partnership throughout the migration to a direct participant set-up in Denmark. Our clients can now benefit from a shorter custody chain, more efficient processing and an enhanced client experience. This is also testament to our commitment to the Nordic region and our growth plans”.

For more info please contact Henrik Ohlsen, Customer Relations & Sales Director:

- Phone number: +45 2910 1202

- Email address: HOhlsen@euronext.com