By Trend and Hedgeclub, Kyiv

trendhedgeclub.com

Falling agricultural commodities prices affecting the Black Sea region

Poland is one of the largest agricultural producers in Europe, with agriculture accounting for 3.8% of its GDP. However, local Polish farmers have been facing some difficulties due to falling prices of agricultural commodities undermining the profitability. This is affecting not only Poland, but the entire Black Sea region. Some claim that the price fall was due to flows of grains from Ukraine.

Poland and Hungary ban grain and food imports from Ukraine

In response, Polish farmers, along with their fellows from Slovakia, Bulgaria, Hungary and Romania, have been organising protests and strikes, demanding government support and higher prices for their crops, pushing the Polish Minister of Agriculture to resign on 5 April. Some farmers have taken their protests a step further by blocking the import of Ukrainian grain. Several politicians asked Brussels to apply duties and quotas on Ukrainian grain, but not oilseeds and their by-products. Such moves pushed Poland and Hungary to ban grain and food imports from Ukraine on 15 April, followed by Slovakia introducing similar measures on 17 April. Meanwhile, Poland and Slovakia will continue to allow the transit of grains from Ukraine through their territories.

Concerning reactions from the market

However, the reaction in the market has been controversial. There were concerns and accusations that some politicians in Poland try to manipulate public opinion, taking advantage of the current situation in the market, ahead of the parliamentary elections to be held later in the year. This has also raised concerns about protectionism and trade barriers.

What is the actual impact of grain imports from Ukraine on prices?

"The amount of grain from Ukraine [via Polish borders] was not significant compared to the local crop. About 800,000 tons of wheat and 1,300,000 tons of corn have been imported to Poland since March 2022. This is not such a large amount," said Andriy Abdulov, a grain trader with the Polish company Agrolok.

Volatile grain markets in 2022

“At the beginning of 2022, grain prices skyrocketed in the global market following the Russia’s aggression of Ukraine. Then, the prices started decreasing in March 2022 when Poland, Romania, Bulgaria, Hungary and the Baltic States decided to help Ukraine to facilitate transit of grains from Ukraine by land to final destinations as the major Ukrainian ports were blocked by the Russian navy. The grain prices kept falling on the international grains market following the creation of the "grain corridor" in July 2022 that partly restored grain shipments from Ukrainian ports,” Andriy Abdulov said.

The prices in the Polish grains market have followed the trend in the global grains market. At the same time, Poland had one of the best crops in recent years, adding pressure on prices in the local market. Exports of wheat and corn from Poland significantly exceeded the volumes of the previous years.

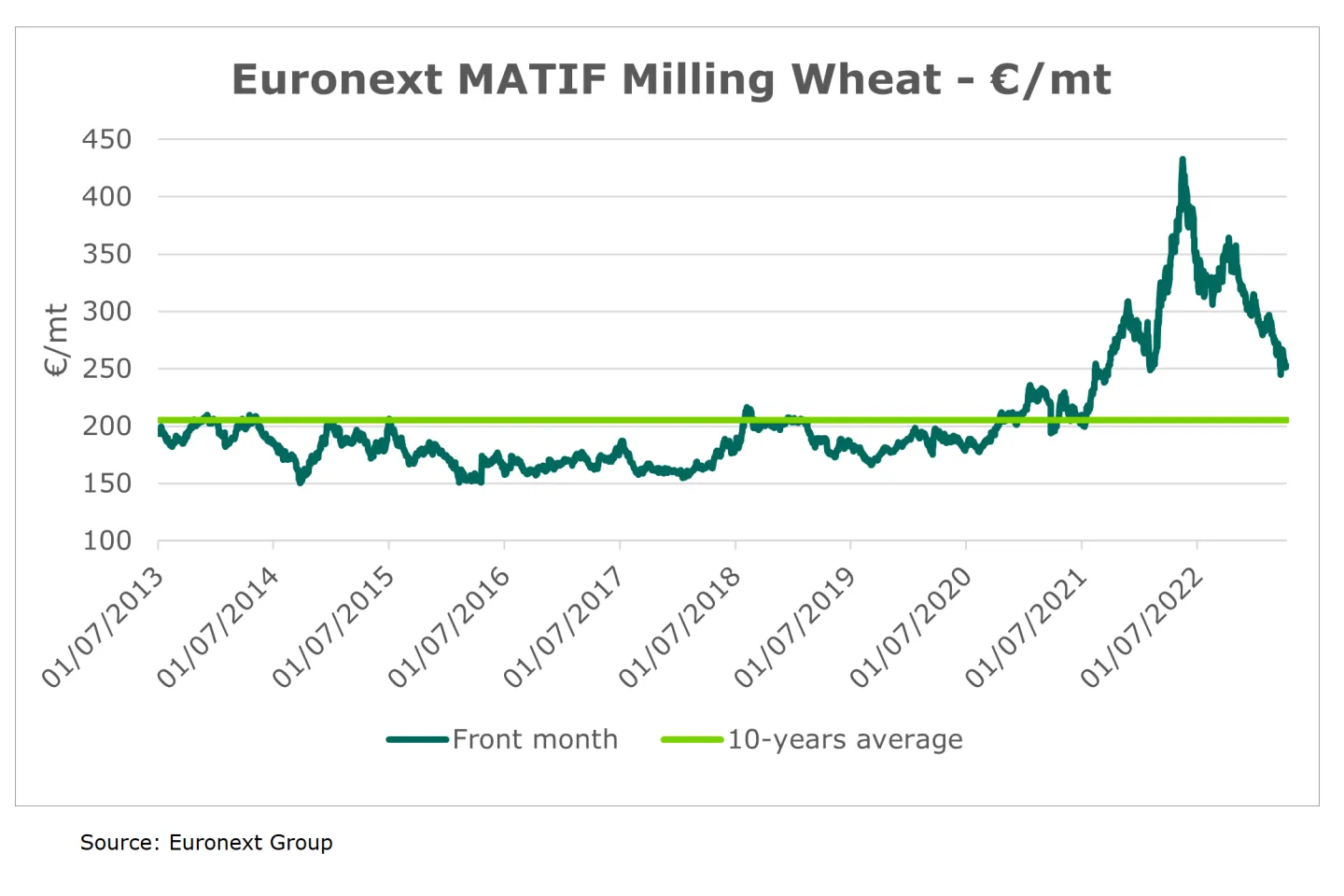

Petr Ciecwierz, advisor to trading company MK Merchants, also emphasises that grain prices have decreased throughout Europe, though they remain at pre-war levels.

Euronext MATIF Milling Wheat Futures trade levels

Thus, Euronext Milling Wheat Futures trade around the same levels as at the beginning of February 2022, and well above the 10-year average:

The narrative behind falling grain prices

However, politicians began to use the narrative about falling prices. "We will have elections this year. The situation in agricultural markets is used by certain political parties and agricultural unions to pressure the government and get more subsidies. Not only the government, but also the political forces that are currently in the opposition, repeat the same narrative," says Petr Ciecwierz.

Are Ukrainian exports impacting Polish grain prices?

"Actually, different media sources provide different information, different data. Some politicians say that we [Poland] need to export 9 million tons of grains [to bring the stocks to usual levels], others estimate this number at 4 million tons. No one even knows how many those reserves are. Therefore, it is not true that exports from Ukraine became the main factor affecting the drop in prices and the situation in Europe," says the market participant.

Influencing market sentiment about Ukrainian grain

The second false thesis of Polish farmers is about the poor quality of Ukrainian grain and the lack of checks at the border. Petr Ciecwierz notes that there is standard quality control at the border when it comes to the EU. All agricultural products are controlled according to European standards.

"The problem is Moscow propaganda. Because agricultural media and social networks, where farmers participate, spread false information. The thesis that the grain that comes from Ukraine passes without control for pesticides, mycotoxins, and the content of insects is not true. The government tried to explain the situation, but it was very limited. They tried to refute such information, but no one listened to them," says Petr Ciecwierz.

Polish farmers putting pressure on the government on grain prices

He also notes that Polish farmers are pressing the government to solve their problems, buy grains from them at prices above the current prices or influence the trading companies buying from farmers to increase the prices. This would be completely against a free market principle.

Another problem: Poland cannot export its grains to a number of North African countries, for instance to Egypt, as Poland cannot provide appropriate certificates for export.

Managing price risk effectively with the Euronext MATIF grain contracts

One of the solutions for farmers would be to manage the price risk in a more effective way to protect themselves from unfavourable price movements. Using diverse hedging strategies, farmers can lock in their selling price to the levels that ensure profitability. For instance, Euronext MATIF Milling Wheat Futures dropped by about €20 between 1 March and 11 April while the drop was more than €70 since August when most wheat was harvested. If farmers fixed the price of their crop between August and March by selling futures, for instance, they would achieve significantly better performances.

By Trend and Hedgeclub, Kyiv

trendhedgeclub.com

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided “as is” without representation or warranty of any kind. Whilst all reasonable care has been taken to ensure the accuracy of the content, Euronext does not guarantee its accuracy or completeness. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced in any form without the prior written permission of Euronext. Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at https://www.euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.