Why momentum investing matters

- Momentum investing is based on a straightforward principle: stocks that have outperformed in the recent past often continue to perform well in the near future.

- Traditional momentum strategies can capture this premium, but often at the cost of short-term swings, high turnover and significant drawdowns.

- The Euronext Momentum Europe 500 Index addresses these challenges by combining short- and medium-term signals, volatility adjustment, buffer rules and an ad hoc review. This delivers the momentum premium in a liquid, long-only format, ready for practical use.

How momentum investing works

Momentum investing seeks to capitalise on the tendency of assets that have performed well recently to continue outperforming in the near future. The approach relies on price trends and relative performance, drawing on the tendency of winning assets to attract continued investor interest.

Index construction: capturing and refining momentum

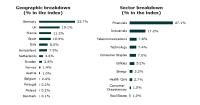

The Euronext Momentum Europe 500 Index selects companies from the Euronext Europe 500 Index whose share prices have delivered the strongest recent (six-month) and medium-term (twelve-month) returns. These returns are adjusted for volatility and are net of the short-term risk-free rate (three-month Euribor), ensuring a focus on risk-efficient performance.

All 500 stocks are scored, and the 125 with the highest momentum scores - reflecting the best balance of return and stability - are selected for inclusion. Constituents are weighted by both momentum score and market capitalisation, balancing pure momentum exposure with investability. This design enables the index to capture European momentum trends while remaining practical for portfolio use.

Managing risk: turnover controls and volatility filters

To maintain exposure to leading stocks while controlling turnover, the index employs liquidity filters, buffer zones and a robust review process. These measures help capture sustained trends and reduce the impact of short-term volatility and market reversals.

Index performance

Safeguarding performance: the ad hoc review mechanism

Regular rebalancing occurs every six months. However, the index also features an ad hoc review as a safeguard against sharp market reversals. If the index’s overall momentum score falls below 85% of its last review level, an unscheduled adjustment is triggered to remove weak performers and realign with prevailing momentum trends.

Contact the team at index-sales@euronext.com for more information