T+1 settlement in Europe is a regulatory development that is part of a broader shift towards faster settlement cycles, designed to improve market efficiency, reduce systemic risk, and align with international standards. Euronext is fully committed to a smooth transition throughout the entire value chain by October 2027.

What is T+1?

The transition to T+1 settlement is an EU-wide initiative that represents a structural, operational and organisational transformation of European financial markets.

The new T+1 model shortens the EU securities settlement cycle, which is currently set to T+2. Under the new model, the settlement of securities transactions (the delivery of the securities and cash, if applicable, from buyer to seller), is completed on the business day immediately following the trade date (T+1).

The go-live for the transition to T+1 is scheduled for 11 October 2027.

Why change the settlement cycle to T+1?

This regulatory development is part of a broader international movement towards accelerated settlement cycles. The move to T+1 is designed to enhance market efficiency, reduce counterparty and market risk, and ensure alignment with global standards.

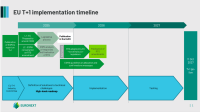

T+1 timeline

The European Securities and Markets Authority (ESMA) published a final report in November 2024 confirming the transition to a T+1 settlement cycle for European markets. The transition will be effective no later than 11 October 2027.