Volatility in commodities markets

Volatility in the commodities markets surged significantly in 2022. This was mainly due to the invasion of Ukraine by Russia in February 2022, and to increased consumption following years of Covid.

The grains and oilseed markets were at the centre of this storm, which was exacerbated by unfavourable weather conditions in some producing areas.

Increased volatility in the grain markets prompted all participants along the value chain, in particular producers, end users and transformers, to seek efficient tools to manage their price risk in order to lock in margins and insure sustainability of their business.

Growing volume Euronext MATIF

This trend has been reflected in growing volume across Euronext MATIF considered as a very useful tool for market players across the world to lay out the price over last years.

The Euronext MATIF grains franchise has grown significantly over the last five years, with volumes increasing by 40%.

Liquidity has continued to build in the milling wheat contract, which has become a global benchmark.

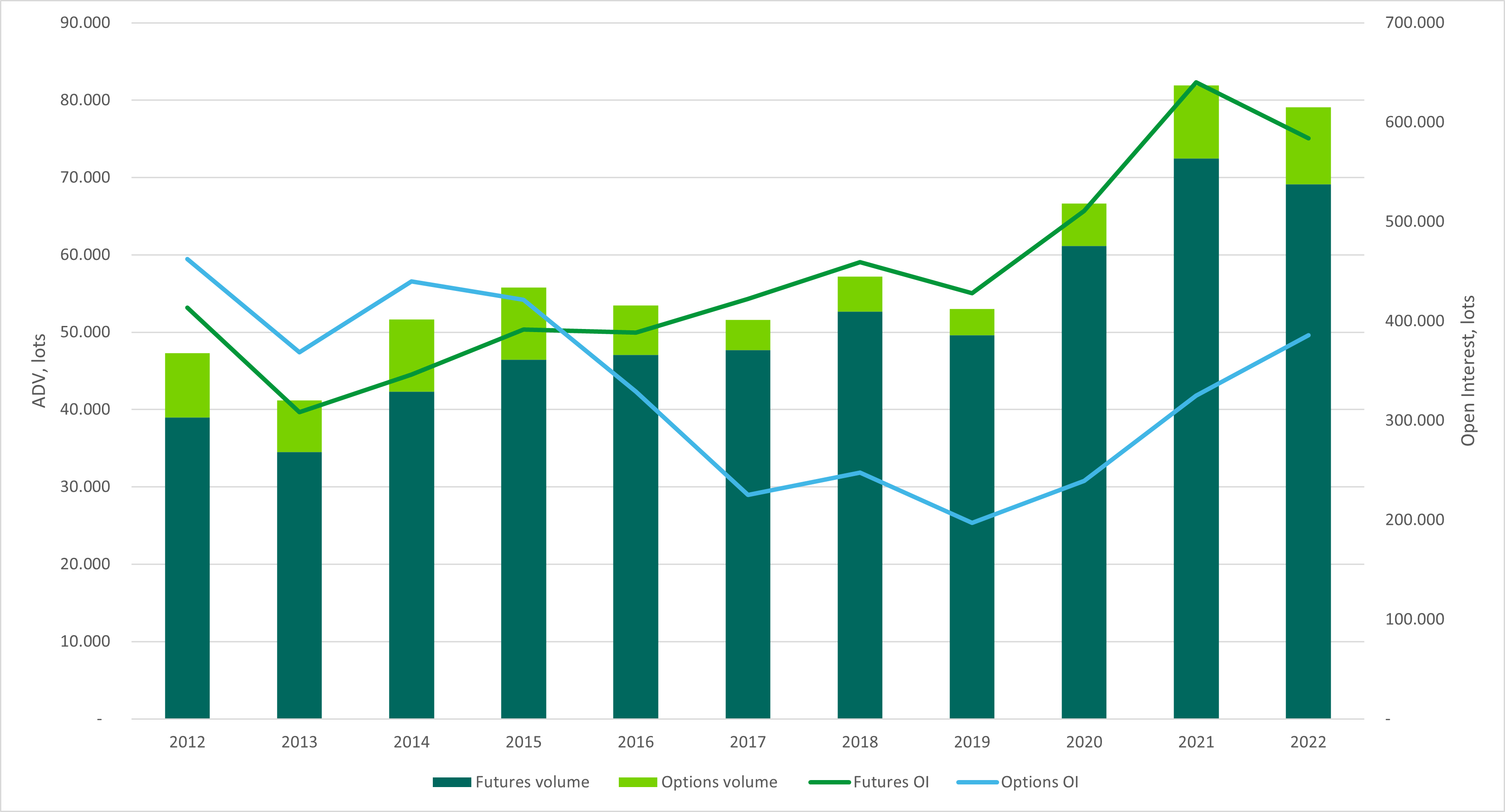

Euronext Milling Wheat, Rapeseed and Corn Futures & Options

Average Daily Volumes and Open Interest

Source: Euronext Group

Options have become an attractive hedging tool over futures over last few years following increased volatility in the markets leading to higher margin requirements by clearing houses.

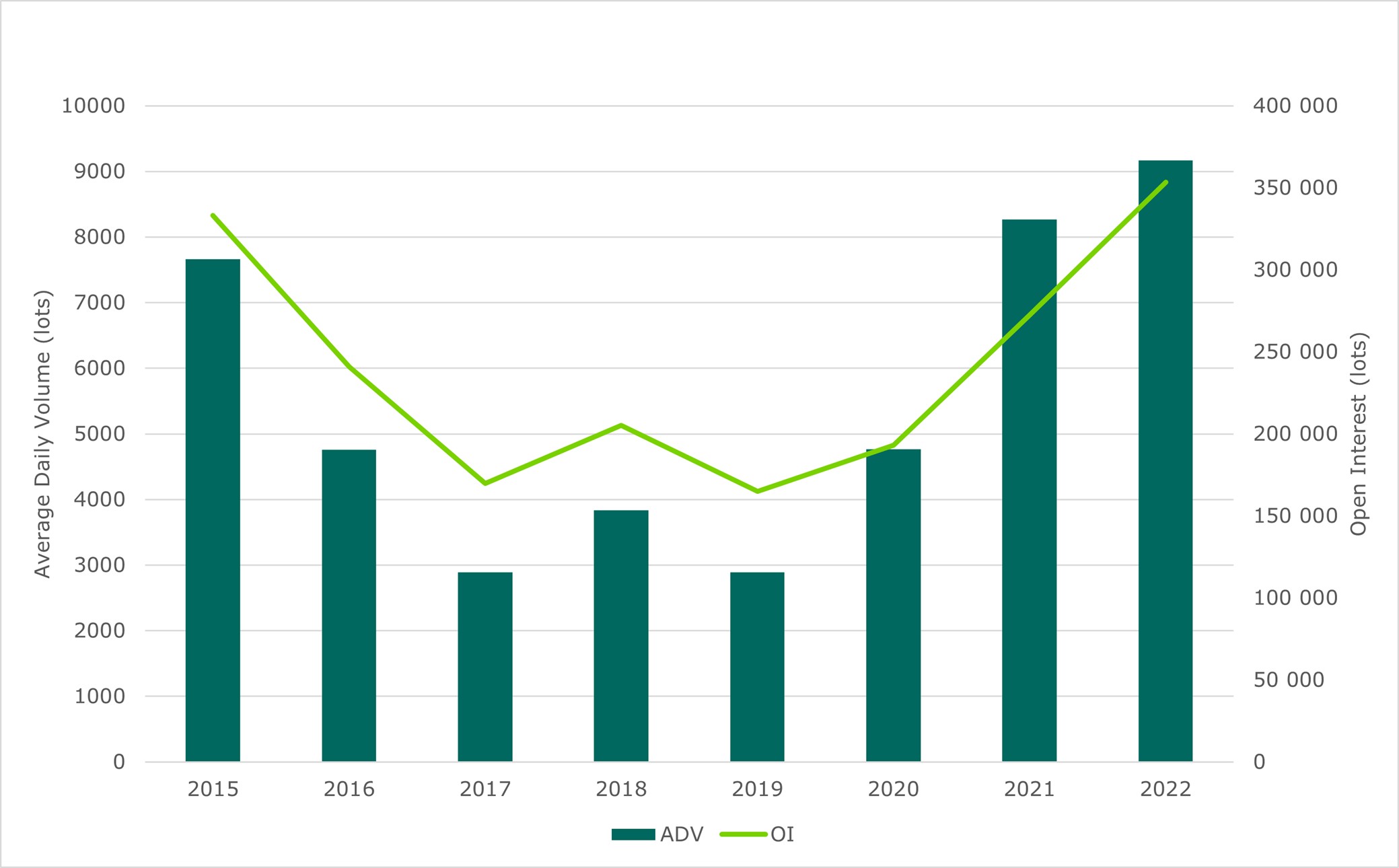

Milling Wheat Options exceeded an average volume of 9,000 lots per day in 2022:

Euronext Milling Wheat Options (OBM)

Average Daily Volume and Open Interest

Source: Euronext Group

This publication is for information purposes only and is not a recommendation to engage in investment activities. This publication is provided by a third party unaffiliated with Euronext, the content therein is not provided or controlled by Euronext nor does it constitute Euronext’s opinion. This publication is provided “as is” without representation or warranty of any kind. Euronext will not be held liable for any loss or damages of any nature ensuing from using, trusting or acting on information provided. No information set out or referred to in this publication shall form the basis of any contract. The creation of rights and obligations in respect of financial products that are traded on the exchanges operated by Euronext’s subsidiaries shall depend solely on the applicable rules of the market operator. All proprietary rights and interest in or connected with this publication shall vest in the party that provided this publication. No part of it may be redistributed or reproduced in any form without the prior written permission of this party.

Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at euronext.com/terms-use.

© 2023, Euronext N.V. - All rights reserved.