What is the Euronext Listed Autocall Index?

The Euronext Listed Autocall Index tracks the performance of the Euronext Listed Auto-call Market in Milan, providing investors with diversified access to listed structured products. This index captures a representative portfolio of auto-callable notes listed and traded on Euronext Milan, primarily linked to major equity indices. Each eligible note is equally weighted, and the index is rebalanced semi-annually to ensure ongoing relevance and transparency.

Key features of auto-callable products

Auto-callable products are structured notes designed to offer attractive and predictable income through regular coupons and early redemption features. These products can deliver equity-linked returns even when markets are flat or rising modestly, making them appealing for investors seeking enhanced yield in low interest rate environments or during periods of moderate market volatility. Auto-callable notes also provide conditional capital protection and defined risk parameters, with downside protection barriers at maturity that offer greater control and visibility over potential outcomes compared to direct equity investments.

How the index works

The Euronext Listed Autocall Index includes only products that track the performance of liquid benchmarks, ensuring high transparency and liquidity. The index is rebalanced twice a year, and each note is assigned equal weight to avoid concentration risk. This approach allows investors to benefit from a diversified exposure to the auto-callable segment of the structured products market.

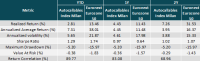

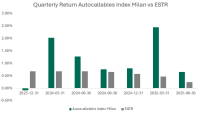

Index performance

Why invest in auto-callable products?

Auto-callable products are tailored to suit various market outlooks - bullish, neutral, or moderately bearish. They are designed to pay regular coupons as long as the underlying asset remains above a specified barrier, providing attractive yields even in stagnant markets. This combination of income potential and risk management features makes them particularly suitable for investors seeking predictable returns and capital protection.

The Milan advantage: a leading exchange-traded market

While most auto-callable products are issued over-the-counter (OTC), limiting price transparency and liquidity, Italy stands out as a leading market for exchange-traded auto-callables. Euronext Milan benefits from a favourable regulatory environment and strong retail investor participation, making it one of Europe's most active markets for these products. Currently, over 250 structured notes are listed, primarily linked to index baskets and single stocks. In 2024 alone, turnover exceeded €500 million, with more than €4.8 billion traded on equity basket underlyings.

Leveraging the Euronext structured products platform

The Euronext structured products platform offers efficient pricing and operational solutions, enabling the creation of bespoke structured notes linked to Euronext indices. This flexibility allows for the rapid development of custom indices and tailored structured products to meet evolving market needs.

Contact the team at index-sales@euronext.com for more information