Q3-2023 is a strong quarter in terms of volume, pulled by the Euronext Wheat and Rapeseed Futures because of hedging Eastern Europe and Australia origins.

We are also returning volumes from legacy commercial clients facing an increased uncertainty over production forecasts in the main producing areas.

The geopolitical situation in the Black Sea region during the summer which was marked by the end of the grain deal corridor, attacks on storages and export facilities in the Ukrainian Danube, and inflationist pressure resulted in higher volatility on the markets.

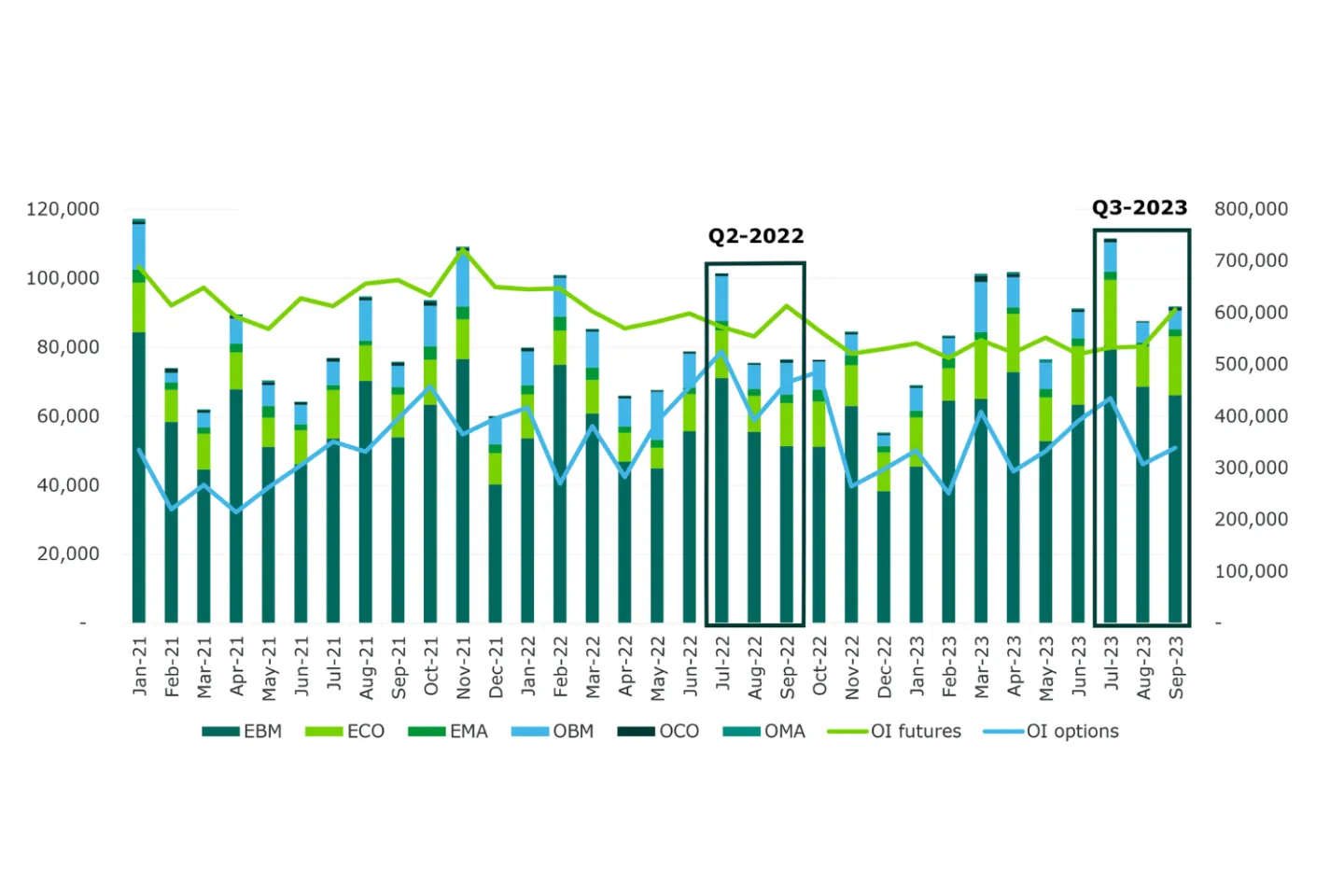

In Q3-2023, we saw +14% in total volume vs Q2-2023, and +13% vs Q3-2022 led by Euronext Wheat (+19% EBM) and Rapeseed Futures (+28% for ECO).

The Euronext Commodities team

Monthly Euronext Euronext ADV and OI per contract

Source: Euronext Group

Update of the ongoing consultation on Euronext Corn

The survey we are running on our Corn Futures contract is in progress. Our main objective is to decide on potential changes to the contract or functionality to attract new market players to further its traction and expand its liquidity.

So far, we received more than 70 answers, split between Cash / Futures traders and brokers, and other players from the agricultural commodities ecosystem.

A summary of the results will be sent by the end of the year.

Latest news about the Durum Wheat contract

Several trades have been made on different maturities. The September maturity settled at €400.50 per ton.

The evolution of the Sitagri European Durum Wheat Index (SEDWI) is available on the Euronext website and its weekly average provided by FinanceAgri is published every Monday.

For more information, visit the Durum Wheat webpage

Reminder of the trading fees waiver for commodities options executed in the Central Order Book

To accelerate liquidity building in the commodity options markets, we introduced on 1 July 2023 a trading fee holiday for options executed in the Central Order Book (COB).

The principal purpose is to increase liquidity on screen and to improve transparency in the markets to a wider group of market players and generate new volumes.

To benefit from the rebate, do not hesitate to contact your intermediary.

| Options Central Order Book Trades - Fees Waiver | Trading Fees |

| Milling Wheat, Corn and Rapeseed | €0 per lot |

| Milling Wheat, Corn and Rapeseed - Strategies legs | €0 per lot |

Euronext Iron Condor with and without Delta

On 1 November, we activated two new strategy types in our Next EUA (p-EUA) test environment for commodity options for trading via the Central Order Book (COB), wholesale and RFC: Iron Condor (Optiq strategy code ‘w’) and Iron Condor versus Underlying (Optiq strategy code ‘v’).

These new strategy types were activated in our production environment on Monday 13 November.

A full overview of the recognised strategies that are available in Optiq can be found in Annexe II to our trading procedures.

Available on the Euronext website

A second version of the Commitments of Traders (COT) report is available on our website. It includes historical graphs, making it easier to read and understand.

Access the additional COT report

Get key insights on the agricultural commodity markets and follow the latest trends via the Commodities Insights articles, made by Euronext and industry experts, as well as access the Euronext Commodities latest newsletters on our website.Access the latest articles and newsletters

The Commodities team at events

During Q3-2023, we took part in several events such as the Bourse décentralisée in Saint-Malo and the European Commodities Exchange, as well as the Semouliers Annual Conference, both in Warsaw.

These events were great opportunities to meet experts from the European agricultural industry.

Find out more

See all our MATIF Commodities contracts on the Euronext Live Markets website.

Contact our team: commodities@euronext.com