-

Listing

-

Trading

Where European Government Bonds meet the futureFixed Income derivativesRead more

Where European Government Bonds meet the futureFixed Income derivativesRead moreTrade Mini Bond Futures on main European Government Bonds

-

Clearing

Step into Europe’s next phase of Repo ClearingRepo ClearingRead more

Step into Europe’s next phase of Repo ClearingRepo ClearingRead moreEuronext is expanding its repo clearing services to boost market access, liquidity provision and collateral optimisation across Europe.

-

CSD

European CSD modelBuilding the CSD of Choice in EuropeRead more

European CSD modelBuilding the CSD of Choice in EuropeRead moreEuronext Securities is shaping the future of European capital markets by enhancing integration, connectivity, and innovation.

-

Technology

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read more

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read moreThe new generation of high-frequency risk trading platforms, offering the highest performance with ultra-low latency and minimal jitter, all at a low total cost of ownership.

-

Data

-

Indices

Access the white paperInvesting in the future of Europe with innovative indicesRead more

Access the white paperInvesting in the future of Europe with innovative indicesRead moreThe first edition of the Euronext Index Outlook series with a particular focus on the European Strategic Autonomy Index.

- Regulation

-

About Euronext

Euronext strategic planInnovate for Growth 2027Read more

Euronext strategic planInnovate for Growth 2027Read moreShaping capital markets for future generations

Vaccibody admitted to trading

Zaptec admitted to trading

Mintra admitted to trading

Euronext announces volumes for September 2020

BRAbank admitted to trading

Healthcare Activos Yield Socimi trading on Euronext Access Paris

Agilyx admitted to trading

Salmon Evolution admitted to trading

OHT admitted to trading

Two TechShare alumni enter European markets on Euronext

Nyxoah and Unifiedpost, from TechShare’s campus to Euronext markets

Only a few months after Nyxoah’s participation in the pan-European TechShare programme, and a few years after that of Unifiedpost’s, the two alumni went public this month. This is the first time that Belgian participants are taking the plunge; they have joined an ever-growing community of listed tech companies. With the full support of their teams and all the tools in hand to be ready for a successful listing operation, they both prepared their listing in the best possible way.

Nyxoah – IPO

To mark Nyxoah’s first trading day, Olivier Taelman, Chief Executive Officer of Nyxoah, rang the bell to open the markets in Brussels and celebrate its listing.

Nyxoah (NYXH) was created in 2009 with a clear purpose: to treat the most frequent sleep trouble, called Obstructive Sleep Apnea (OSA). This disorder is touching 7,5% of the USA's population and 5% of the European. Nyxoah’ solution is an easy-to-use, comfortable and efficient sleep apnea treatment that is composed of an implant and an external patch that works with neurostimulation. The medtech company successfully raised €73.7 million during its IPO on 18 September, it was multiple times oversubscribed and closed ahead of schedule.

Unifiedpost – Private Placement

Hans Leybaert and Laurent Marcelis, respectively CEO and CFO of Unifiedpost, register the company in Brussels' symbolic order book, emblem of the historical stock exchange.

Created in 2001, this fintech participated in TechShare’s 2016-2017 edition. The Unifiedpost’s (UPG) mission is to help customers structure complex financial ecosystems by delivering cloud-based platform for SME business services built on documents, identity and payments, the company today reaches more than 400,000 SMEs and more than 250 large corporate and governments. With its private placement on 22 September, the group has joined 299 other TMT companies already listed on Euronext markets.

Euronext, the listing venue of choice for European tech companies

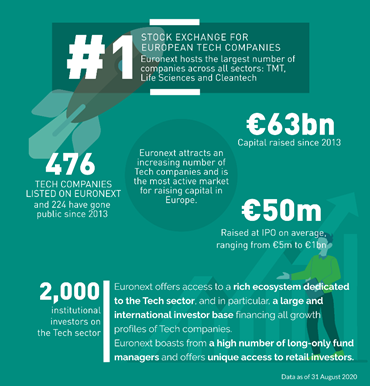

Nyxoah and Unifiedpost have joined Europe's largest community of listed tech companies. Euronext attracts an increasing number of Tech companies and is the most active market for raising capital in Europe.

About TechShare

TechShare is a pan-European programme dedicated to Tech business leaders, which allows them to acquire all the knowledge and tools necessary to initiate them into the capital markets.

Visit euronext.com/en/raise-capital/tech/techshare to learn more.