-

Listing

-

Trading

Where European Government Bonds meet the futureFixed Income derivativesRead more

Where European Government Bonds meet the futureFixed Income derivativesRead moreTrade Mini Bond Futures on main European Government Bonds

-

Clearing

Step into Europe’s next phase of Repo ClearingRepo ClearingRead more

Step into Europe’s next phase of Repo ClearingRepo ClearingRead moreEuronext is expanding its repo clearing services to boost market access, liquidity provision and collateral optimisation across Europe.

-

CSD

European CSD modelBuilding the CSD of Choice in EuropeRead more

European CSD modelBuilding the CSD of Choice in EuropeRead moreEuronext Securities is shaping the future of European capital markets by enhancing integration, connectivity, and innovation.

-

Technology

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read more

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Read moreThe new generation of high-frequency risk trading platforms, offering the highest performance with ultra-low latency and minimal jitter, all at a low total cost of ownership.

-

Data

-

Indices

Access the white paperInvesting in the future of Europe with innovative indicesRead more

Access the white paperInvesting in the future of Europe with innovative indicesRead moreThe first edition of the Euronext Index Outlook series with a particular focus on the European Strategic Autonomy Index.

- Regulation

-

About Euronext

Euronext strategic planInnovate for Growth 2027Read more

Euronext strategic planInnovate for Growth 2027Read moreShaping capital markets for future generations

Lifecare transfers to Euronext Oslo Børs

New structured products available for trading on Euronext: Capital Protection Certificates

New structured products available for trading on Euronext: Capital Protection Certificates

Société Générale has expanded its range of investment products in France and the Netherlands with the launch of Capital Protection Certificates.

Capital Protection Certificates allow investors to protect themselves against falling prices while benefitting partially or fully from a possible price increase of the underlying value of the certificate, such as a share or an index.

Listed on Euronext, the products can be traded through various retail banks and brokers.

Christophe Cox, Vice President Listed Structured Products Netherlands & Belgium at Société Générale sat down to answer the following questions:

- What does Société Générale do in the Netherlands with the issuance of listed products?

- What is a Capital Protection Certificate?

- How much capital can I lose when investing in this product?

- What is the difference between a Capital Protection Certificate with a Cap and one without a Cap?

- Can I sell a Capital Protection Certificate before its maturity date?

- Where can I trade Capital Protection Certificates?

- Where can I learn more about the listed products of Société Générale?

Watch the interview to get information on Société Générale's Capital Protection Certificates:

Look back on the gong ceremony organised in Euronext Amsterdam to celebrate the launch of Capital Protection Certificates:

Discover the full range of Structured Products available on Euronext

Euronext Securities Porto update its Fee Books.

Euronext Securities Porto has decided to adjust the price list to be applied to the services provided to Financial Intermediaries and to the services provided to Issuer Entities,. This adjustment is necessary to address the rising costs driven by inflation, which, according to the latest data from the Bank of Portugal, is projected to reach 2.1% in 2025.

Therefore, as of 1 January 2025, Euronext Securities Porto will implement a fee adjustment of 2.0%, which is below the projected inflation rate. This approach allows Euronext Securities Porto to continue partially absorbing the anticipated cost increase for 2025.

Mota-Engil Successfully Issues €80 Million in Sustainability-Linked Bonds

Mota-Engil has successfully raised €80 million through a sustainability-linked bond issuance, now listed on the Euronext Lisbon market. These bonds are linked to the company's performance in achieving specific sustainability targets, including increasing the percentage of local talent in management positions. This bond structure aligns with Mota-Engil's ongoing focus on integrating sustainability into its financial and operational strategies.

The issuance attracted significant interest, with close to 5,000 retail investors participating. Total demand reached €86 million, surpassing the initial offering of €50 million by 1.08 times, following an increase in the offer to €80 million.

Founded in 1946, Mota-Engil operates in more than 20 countries across Europe, Africa, and Latin America, delivering large-scale projects in sectors such as transportation, energy, environment, and mining. The company continues to prioritize sustainability and innovation as key elements of its business model.

Euronext Lisbon acknowledges this milestone and remains committed to supporting Mota-Engil's future endeavors. You can access the detailed results in the presentation below.

ELITE hosts the 5th edition of ELITE Day

Behind the scenes at the Stock Exchange

In this monthly edition, Delphine D'Amarzit, CEO of Euronext Paris, explains how the Euronext markets operate in Paris and across Europe. She highlights the key players on the stock exchange and the advantages the Exchange offers, such as the large number of institutional investors, and the technology in the market surveillance room that enable real-time monitoring of transactions.

Activate sub titles (CC) for EN

Euronext Group Training Services - Unlock your company skillset

Unlock your company skillset Potential with Academy – Euronext Group Training Services

Developing Capital Markets Skillsets to Drive Sustainable Growth

Euronext Securities Copenhagen is excited to announce that, in collaboration with Academy – Euronext Group, we now offer our customers access to a diverse range of high-quality training programs. These courses are designed to help companies and professionals excel in the ever-evolving capital markets landscape by providing the skills and insights necessary to drive sustainable growth and innovation.

Established in 2000 and part of the Euronext Group since June 2021, Academy has become a leading hub for capital markets education, supporting companies, policymakers, investors, banks, and students alike.

Through the Academy, You have the unique opportunity to access a diverse portfolio of interactive, peer-driven courses meticulously designed to meet the evolving demands of today’s financial markets.

Beyond the training sessions, you can also become part of the prestigious Academy Alumni Community, allowing you to continue your learning journey and foster long-term connections with industry peers.

For 2024, Academy has developed an upcoming IR Fundamentals and Advanced programme explicitly addressed to the IR Danish community. The programme will be held in-person in Copenhagen, at the Euronext Securities offices, on 24-25 October and 12th November 2024 in partnership with DIRF - Dansk Investor Relations Forening and is designed to equip junior and senior IR managers with essential skills to thrive in the world of investor relations.

Bespoke Solutions and Expert-Led Courses

Academy provides a wealth of training solutions designed to meet the needs of diverse professionals, from junior employees to C-suite executives and board members. Whether you’re looking for tailor-made courses focused on core financial topics or open programs available year-round, Academy’s internationally distinguished faculty—composed of market practitioners, academics, and Euronext experts—ensures a top-tier educational experience.

Additionally, Academy offers certification programs aimed at building critical skills in high-demand capital markets fields, such as investor relations, ESG, risk management, and financial instruments. Companies can also benefit from bespoke ESG coaching sessions, tailored to specific industry needs and led by leading sustainability experts.

A Broader Portfolio of Services

The Academy portfolio complements the existing range of Euronext Corporate Services available to Euronext Securities Copenhagen customers, providing holistic solutions that cover a wide spectrum of capital markets functions. By combining training with corporate governance and compliance tools, your organization can streamline processes, enhance investor communication, and stay ahead of regulatory trends.

Upcoming Courses and Customizable Options

In addition to standard course offerings, Academy can work closely with your organization to develop fully customized training programs tailored to your specific challenges and opportunities. The focus on collaborative learning ensures that participants engage in practical, peer-to-peer discussions that boost innovative thinking and knowledge sharing.

Take a look at all available courses here: Academy Education Suite: Capital Markets Training Courses (euronext.com)

Ready to Get Started?

For more information about the Academy services or to discuss how to create a customized program for your company, please reach out to the Academy team. Elevate your expertise, drive sustainable growth, and make the most of our collective capital markets knowledge through Academy-Euronext Group.

Contact Information:

Academy – Euronext Group

Phone: +39 02 72426 086

Email: academy@euronext.com

Euronext rings the bell to support financial literacy and mark World Investor Week

Euronext was proud to participate in the global ‘Ring the Bell’ initiative to kick off World Investor Week, highlighting its commitment to financial literacy and investor protection.

As the leading pan-European market infrastructure, Euronext recognises the need to empower investors with the knowledge and tools necessary to make informed and responsible decisions in an increasingly complex financial landscape.

Why financial literacy?

Stock exchanges play an important role in promoting financial stability for everyone. It is essential for savers, private investors, policyholders, pensioners and young people to have the opportunity to invest in their futures.

Exchanges like Euronext facilitate capital-raising for companies and governments worldwide, contributing to job creation. The Group also works alongside its partners and employees to create and share educational resources focused on financial literacy.

Through the Euronext Foundation, the Group has also formed partnerships with various regional charities that emphasise financial education within communities globally.

The importance of financial literacy for investor protection

- Informed decision-making: Investors with a strong foundation in financial literacy are better positioned to evaluate market trends and understand risk factors. This can help them avoid poor investments and financial scams that could jeopardise their savings.

- Risk management: Understanding different investment strategies allows investors to manage their portfolios effectively. They can identify high-risk products and make conservative choices when necessary, reducing the likelihood of significant losses.

- Fraud awareness: Financially literate investors are less vulnerable to fraudulent schemes. By recognising warning signs of fraud and conducting thorough due diligence, they can protect their investments from scammers and unethical practices.

Bell ceremonies for financial literacy

To mark the opening day of World Investor Week, key stakeholders joined Euronext in different locations for a bell ceremony to celebrate financial literacy. Euronext’s participation reflects its mission to foster a resilient and informed investor community, ensuring that individuals can navigate financial markets with confidence and safeguard their financial futures.

In Belgium, Euronext Brussels CEO Benoît van den Hove was joined by Jean-Paul Servais, Chair of the International Organization of Securities Commissions (IOSCO) and Chairman of Belgium’s Financial Services and Markets Authority (FSMA).

In Italy, Pasquale Munafò, Senior Advisor of CONSOB and Chair of IOSCO's Committee for Retail Investors, rang the bell together with Fabrizio Testa, CEO of Borsa Italiana.

Meanwhile, in Portugal, Isabel Ucha, CEO of Euronext Lisbon rang the bell with the Portuguese Association of Investment, Pension and Asset Funds (APFIPP). Together, they launched a special episode of Portugal’s number one podcast, in partnership with MoneyLab, focusing on the challenges and opportunities for young investors.

Euronext’s commitment to financial literacy and investor education

Through its comprehensive resources, Euronext aims to equip market participants with the knowledge they need to use financial markets effectively, not only for growth and sustainability but also to protect their investments.

Empowering market participants

Euronext recently launched an in-depth educational programme for retail investors, developed in collaboration with key market players. The programme kicked off with a series of monthly webinars focused on derivatives, such as options and futures trading, in partnership with Interactive Brokers and WH Selfinvest, with other partnerships to follow. These sessions provide in-depth insights into the fundamentals of trading products and explore how they can be effectively integrated into various trading strategies, empowering participants to make informed and strategic investment decisions.

Since the launch of the Euronext Foundation in 2023, the Group has expanded its financial literacy efforts to engage with future investors and professionals. In addition to local programmes and partnerships, its key global programmes include:

- the Euronext Blue Challenge, which introduces students aged 16 to 18 to sustainable finance, helping them develop entrepreneurial skills and an understanding of responsible investing.

- the Euronext Trading Game, a European trading simulation competition that teaches university students about trading strategies, risk management, and sound investment principles.

Investor protection through education

By prioritising financial literacy, Euronext empowers investors to protect themselves from the dangers of uninformed decisions, market risks, and fraud. The Group’s commitment to education ensures that all market participants – new or experienced – can navigate the financial landscape confidently and responsibly, ultimately contributing to a safer and more resilient financial system.

What is a long put option?

Options strategies – long put

Benefits, risks and examples of a long put option.

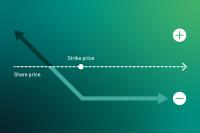

The long put option strategy anticipates a decline in the price of an underlying asset. This strategy allows for significant profit potential with limited risk, making it an attractive choice for bearish market conditions. This article explores the fundamentals of the long put option strategy, its benefits and risks, and how to effectively implement it.

What is a put option?

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a specified quantity of an underlying asset at a predetermined price (the strike price) within a set period. The buyer of the put option pays a premium to the seller for this right.

In return, the seller of the option has the obligation to buy, upon the request of the buyer, a specified quantity of an underlying asset at a predetermined price (the strike price). This strategy is known as a short put option.

Unlike a call option, which benefits from rising prices, a put option profits when the underlying asset’s price falls.

Both buyers and sellers of put options can terminate either their right or obligation by a reverse (closing) transaction.

Understanding the long put option strategy

A long put option strategy involves purchasing put options with the expectation that the underlying asset’s price will decline. This bearish strategy allows the investor to capitalise on downward price movements, providing an opportunity for significant profits while limiting potential losses to the premium paid.

Key components of a long put option

- Premium

The price paid for the option. - Strike price

The predetermined price at which the holder can sell the underlying asset. - Expiry date

The date by which the option must be exercised or will expire worthless.

Advantages of the long put option strategy

- Limited risk

The maximum loss is limited to the premium paid, providing a defined risk strategy. - Leverage

Put options provide leverage, allowing investors to control a larger position with a smaller capital outlay compared to short selling the stock outright. - Profit potential

Significant profits can be realised if the underlying asset depreciates substantially, offering high reward potential for a relatively low initial investment. - Hedging

Investors can use long puts to hedge against potential declines in their existing stock positions, effectively reducing the overall risk of their portfolio.

Risks of the long put option strategy

- Time decay

Options are wasting assets, meaning their value erodes over time, especially as the expiry date approaches. This time decay can work against the investor if the expected price movement does not occur quickly enough. - Volatility

While options can benefit from increased volatility, unexpected decreases in volatility can reduce the option’s value. - Out-of-the-money risk

If the underlying asset does not fall below the strike price by expiry, the option will expire worthless, resulting in a total loss of the premium paid.

Example of a long put option

Suppose you believe Company XYZ’s stock, currently trading at €50, will decline significantly over the next three months. You decide to purchase a put option with a strike price of €45 expiring in three months, costing €3 per share (options typically represent 100 shares, so the total cost would be €300).

Profit and loss potential of a long put

- Breakeven point

The stock price at expiry must fall below the strike price minus the premium paid for the investor to break even. In this example, the breakeven price would be €42 (€45 strike price – €3 premium). - Potential profit

If the stock price falls significantly below the breakeven point, the profit potential increases. For example, if XYZ’s stock drops to €30, the profit would be (€45 – €30 – €3) x 100 = €1,200. As the stock price would not drop below €0 the profit is maxed at €4,200. - Maximised potential loss

The maximum loss is limited to the premium paid. In this case, the most the investor can lose is €300 if the stock remains above €45 by the expiry date.

Implementing the long put option strategy

- Market analysis

Conduct thorough research and analysis to identify potential stocks or assets expected to decline in value. This can involve technical analysis, fundamental analysis, or both. - Select the strike price and expiry date

Choose a strike price that reflects your market outlook and an expiry date that allows enough time for the expected price movement to occur. - Monitor the position

Regularly review the position and market conditions. Be prepared to adjust the strategy if the underlying asset’s price movement or volatility changes significantly. - Exiting the position

Decide in advance your profit targets and loss limits. Consider exiting the position if the stock reaches your target price or if it becomes clear that the expected price movement will not occur within the desired timeframe.

Long put vs. other strategies

The long put option strategy is often compared with other strategies like short selling, long call options, and protective puts.

Versus short selling

A long put benefits from price declines and has limited risk (the premium paid), while short selling involves borrowing and selling the stock, which can carry unlimited risk and margin requirements.

Versus long call options

While a long call profits from price increases, a long put profits from price decreases, making it a complementary strategy for bearish market views.

Versus protective puts

Protective puts involve buying put options to hedge an existing stock position. A long put can serve a similar purpose but is used independently to speculate on price declines.

Practical tips to increase the possibility for success

- Start small

If you’re new to options trading, start with a small position to understand how the market works and gain experience without taking on significant risk. - Use technical analysis

Technical indicators and chart patterns can help identify potential entry and exit points for the strategy. - Stay informed

Keep up with market news, earnings reports, and other factors that can influence the price of the underlying asset. - Risk management

Always be aware of your risk tolerance and never invest more than you can afford to lose. - Diversify

Don’t put all your capital into one position. Diversifying your investments can help spread risk and increase the chances of overall success.

The long put option strategy is a powerful tool for investors looking to capitalise on anticipated price declines in an underlying asset while limiting their downside risk. By understanding the key components, advantages, and risks, and by implementing the strategy with careful market analysis and risk management, investors can potentially achieve significant profits. As with any investment strategy, thorough research and prudent decision-making are essential for success in options trading.

Investing in the financial markets requires a deep understanding of various strategies to maximise returns while managing risk. Please consult your bank or broker for advice or read the Key Information Document to get a better understanding of all risks and costs involved.

See also: