-

Quarantaduesima ammissione del 2021 su Euronext Growth Milan

-

Integrated System Credit Consulting Fintech porta a 173 il numero delle società quotate su Euronext Growth Milan

-

Volume totale di collocamento dell'offerta pari a €16,0 milioni

Milano – 22 dicembre 2021 – Borsa Italiana, parte del Gruppo Euronext, dà oggi il benvenuto a Integrated System Credit Consulting Fintech su Euronext Growth Milan.

Integrated System Credit Consulting Fintech è specializzata nell’analisi e nell’acquisto di portafogli granulari non performing loans (NPL).

Integrated System Credit Consulting Fintech rappresenta la quarantaduesima ammissione da inizio anno sul mercato di Borsa Italiana dedicato alle piccole e medie imprese e porta a 173 il numero delle società attualmente quotate su Euronext Growth Milan.

In fase di collocamento Integrated System Credit Consulting Fintech ha raccolto €14,5 milioni, escludendo il potenziale esercizio dell’opzione di over-allotment. In caso di esercizio integrale dell’over-allotment l’importo complessivo raccolto sarà di €16,0 milioni. Il flottante al momento dell’ammissione è del 22,48% e la capitalizzazione di mercato all’IPO è pari a €64,5 milioni.

Gianluca De Carlo, Amministratore Delegato di Integrated System Credit Consulting Fintech, ha detto: ""L'approdo oggi di ISCC Fintech su Euronext Growth Milan rappresenta un passo importante nel percorso di crescita della nostra società che mira ad essere sempre di più punto di riferimento nel panorama italiano degli NPL, in particolare nel settore del cosiddetto credito "granulare". Credo che il mercato abbia apprezzato la nostra mission e cioè quella di approcciarsi al credit management avendo sempre contezza di avere davanti a noi persone, famiglie ed imprese, non solo debitori.Un ringraziamento speciale va a coloro che hanno creduto in questa entusiasmante avventura e cioè gli investitori, tutti di altissimo profilo, che hanno deciso di puntare sul nostro modello di business ma anche a tutto il team di ISCC Fintech fatto di grandi professionalità ed infine ai nostri advisor che ci hanno guidato nel faticoso percorso della quotazione. Da domani continueremo con maggior entusiasmo nel nostro cammino investendo ancora in tecnologia e uomini, nella consapevolezza, come ricorda il nostro Presidente, che anche il credit management può essere di aiuto a famiglie ed imprese in modo che possano tornare finalmente soggetti del mondo del credito".

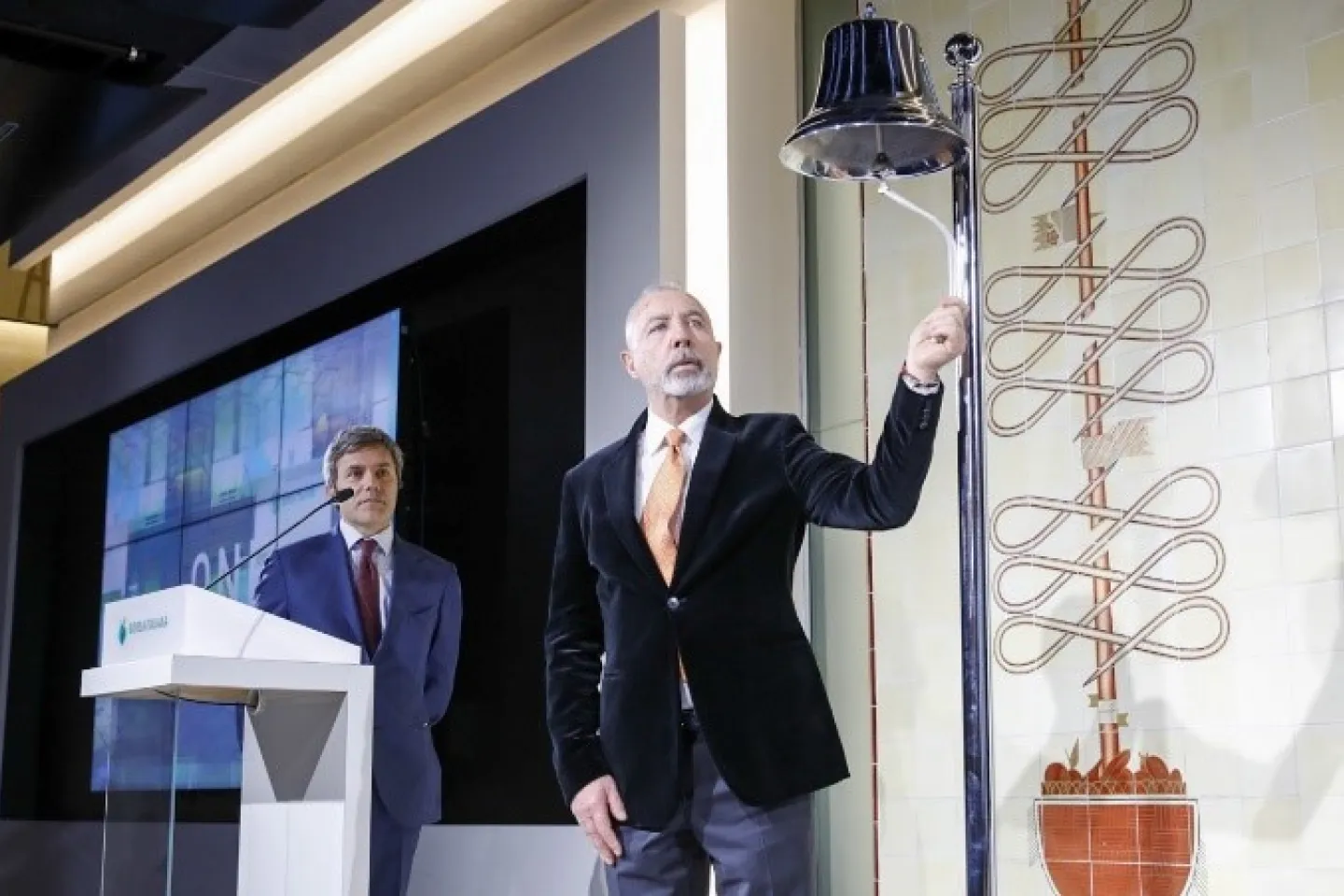

Caption: Gianluca De Carlo, CEO of Integrated System Credit Consulting Fintech, rang the bell during the market open ceremony this morning to celebrate the Initial Public Offering of the company.

Integrated System Credit Consulting Fintech

Integrated System Credit Consulting Fintech, established in December 2019, is a company specialised in the analysis and purchase of granular non-performing loans (so-called NPL) portfolios. It also operates in the management and recovery of such credits (so-called "Credit Management" activity), in the management of credit recovery out of court (through phone collection and home collection actions) and in judicial recovery through the subsidiary Lawyers StA.

The thirty years of operation in the loans sector through the “Cession of the Fifth” regime and through the rich database on customers defined as “bad customers”, allows ISCC Fintech to be able to operate in this market in a timely manner, thanks to the in-depth knowledge of this specific category of debtors.