Global Derivatives ADV Down Year-over-Year and Month-over-Month, excluding Bclear

European Cash Equities ADV Up Year-over-Year but Down Sequentially

U.S. Cash ADV Down Year-over-Year but Up Sequentially

January 7, 2014 – NYSE Euronext today announced trading volumes for its global derivatives and cash equities exchanges for December 2013[1]. Global derivatives average daily volume (“ADV”) of 5.9 million contracts, excluding Bclear in December 2013 decreased 7.6% compared to December 2012 and decreased 10.8% from November 2013. U.S. equity options volumes in December 2013 decreased 13.2% compared to December 2012 and decreased 9.9% sequentially. ADV in U.S. cash equities declined 8.7% year-over-year but increased 0.9% month-over-month. European cash equities ADV in December 2013 increased 13.6% compared to December 2012, but decreased 9.3% from November 2013 levels.

Highlights

- NYSE Euronext global derivatives ADV in December 2013 of 5.9 million contracts, excluding Bclear decreased 7.6% from December 2012 and decreased 10.8% from November 2013 levels.

- NYSE Euronext European derivatives products ADV in December 2013 of 2.4 million contracts, excluding Bclear, increased 1.5% compared to December 2012 but decreased 13.3% from November 2013 levels. Including Bclear, NYSE Liffe’s trade administration and clearing service for OTC products, European derivatives ADV decreased 11.3% compared to December 2012, and decreased 3.9% from November 2013. Total MSCI World Index yearly volumes were up 31% to 337,000 lots, with open interest of over 110,000 lots, up 245% from December 2012.

- NYSE Euronext U.S. equity options (NYSE Arca and NYSE Amex Options) ADV of 3.4 million contracts in December 2013 decreased 13.2% compared to December 2012 levels and decreased 9.9% from November 2013 levels. NYSE Euronext’s U.S. options exchanges accounted for 24.5% of total U.S. consolidated equity options trading in December 2013, down from 27.2% in December 2012, and down from 26.0% in November 2013.

- NYSE Liffe U.S. ADV of approximately 65,300 contracts decreased from 72,600 contracts in December 2012 but increased from 32,300 contracts in November 2013. 2013 ADV vs. 2012 ADV for MSCI futures is up 71%. OI for year end 2013 vs. year end 2012 is up 48%.

- NYSE Euronext European cash products ADV of 1.2 million transactions in December 2013 increased 13.6% compared to December 2012, but decreased 9.3% compared to November 2013.

- NYSE Euronext U.S. cash products (NYSE, NYSE Arca and NYSE MKT) handled ADV of 1.4 billion shares in December 2013 decreased 8.7% compared to December 2012 but increased 0.9% compared to November 2013. NYSE Euronext’s Tape A matched market share in December 2013 was 31.0%, down from 31.9% in December 2012, but up from 29.5% in November 2013.

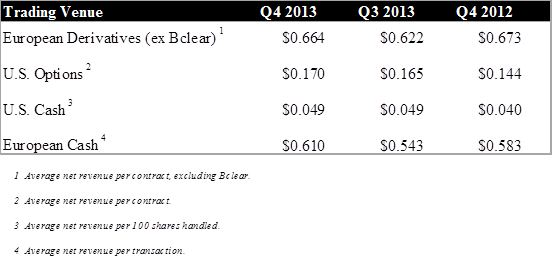

- The preliminary average net revenue per transaction type (as defined below) for each of the primary trading venues in the fourth quarter of 2013 is included below:

Please click here for the Monthly Transaction Activity Data Table.

[1] All NYSE Euronext derivatives transactions count buy and sell orders together as a single transaction. NYSE Euronext European equities transactions count each buy and sell order as separate transactions, NYSE Euronext U.S. equities transactions count buy and sell orders together as a single transaction.