With the upcoming launch of the SCoRE (Single Collateral Management Rulebook for Europe) standards, the European markets will move one step further in their efforts to standardise corporate actions and remove legacy barriers and obstacles. Standardisation is welcome and necessary, but more is needed to address fragmentation. In this article, we look at how Euronext Securities’ new corporate actions platform will deliver the benefits of harmonisation to market participants.

In November 2021, Euronext announced its Growth for Impact 2024 strategic plan, which included a three-year roadmap designed to unlock the power of Euronext Securities as a European network of CSDs, while respecting local business models and specificities. One of the main strategic pillars is convergence – building a common foundation of technology and best practices across all four Euronext CSDs.

“Our strategy is about making it easier for our customers to interact with us across markets,” states Pierre Davoust, Head of CSDs at Euronext. “When we speak with our customers and when we analyse the situation across Europe, we can see that the number one pain point for clients operating in multiple markets is corporate actions. Corporate actions standards already exist, but not all CSDs fully comply with these standards, and there are many ways to understand and deliver the same standard. So, our goal now is to harmonise – not just standardise – the way corporate actions are processed across our four markets.”

In determining the best approach to harmonising corporate actions, Euronext Securities has drawn on the experiences of other business areas in the Euronext Group, as Pierre Davoust explains: “We learned a great deal as we scaled our common trading platform Optiq®, which is at the core of Euronext’s model, across our exchanges in Europe. We’ve seen the benefits of rolling out a common technology across multiple markets, while keeping strong roots locally.”

Delivering on SCoRE standards by November 2023

In November 2023, the European Central Bank (ECB) will launch its new collateral system, the Eurosystem Collateral Management System (ECMS). As part of this launch, the ECB has introduced new SCoRE standards, which set new rules for billing, corporate actions and triparty collateral. Every market participant using this new system must comply with these standards.

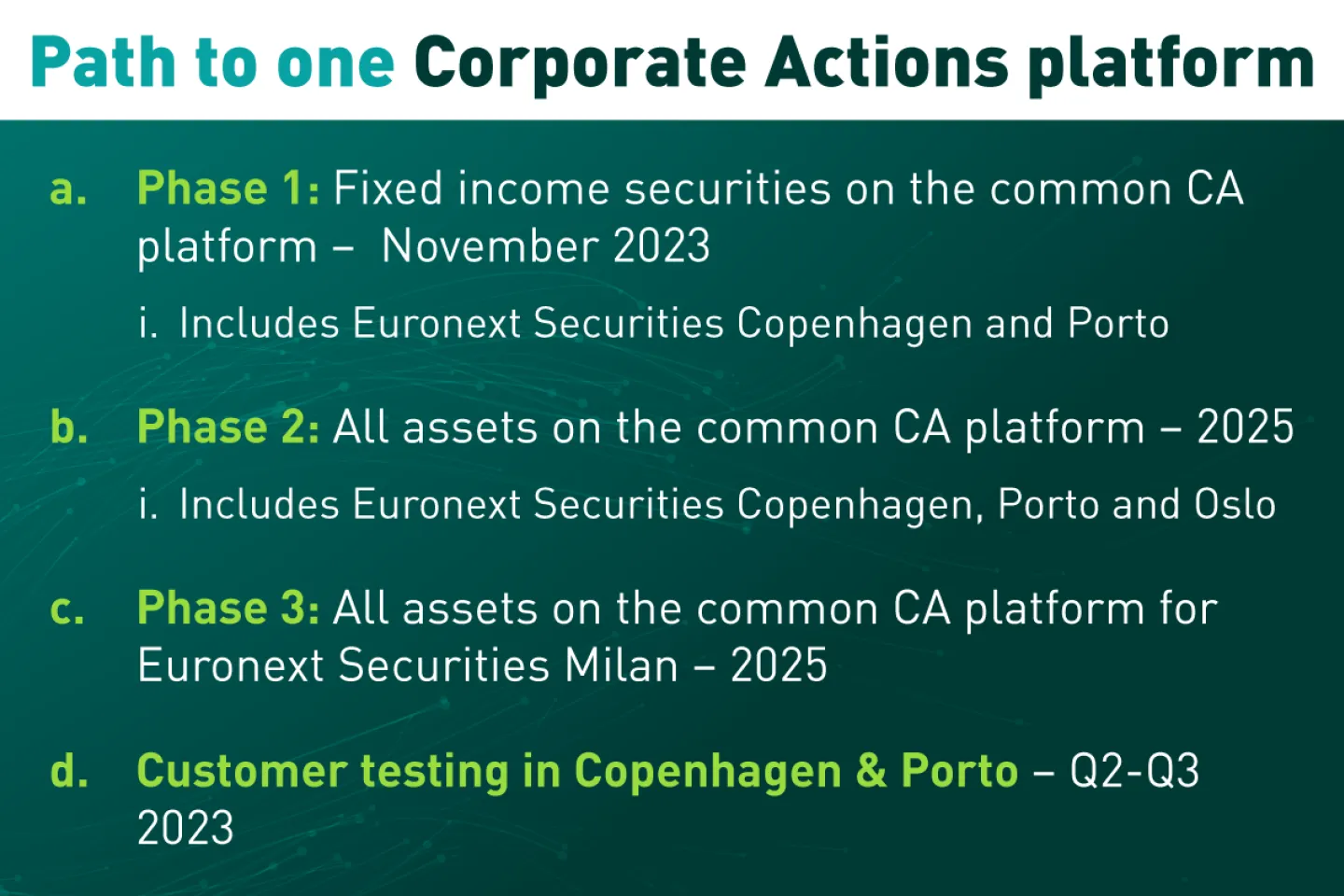

Euronext Securities will deliver full compliance with these standards in Copenhagen, Oslo, and Porto leveraging its new corporate actions platform. In Milan, Euronext Securities will make the necessary adaptations in the local system to comply and migrate to the new platform in 2025. This compliance is crucial as it will ensure euro-denominated bonds issued through our CSDs qualify for ECB collateral programmes.

According to David Durand, Programme Director running the corporate actions programme at Euronext Securities, the launch of the new collateral system is an opportune time to address the varied approaches to corporate actions across Euronext Securities. “When we look at our network of CSDs today, we see a wide range of approaches and systems; however, modernising and converging without strong business incentive is not suitable,” David Durand states. “Additionally, our existing platforms don’t comply with the coming SCoRE standards. Therefore, our programme was the perfect fit between mandatory standardisation and matching our convergence ambition.”

The corporate actions process is one of the largest hurdles to standardisation. It is the next barrier to be toppled to create a more harmonised European financial market infrastructure.” – David Durand, Programme Director, Euronext Securities.

Increasing market efficiency

With the new corporate actions system, Euronext Securities will be aligned with international corporate actions and ISO standards, which will also make it easier for all actors through the value chain. “When each CSD’s processes are aligned to international standards, this will make it more efficient for our customers to access CSD services in multiple markets,” David Durand says, highlighting how this increased market efficiency will in turn benefit all market participants. “Everyone wants greater efficiency in the market. To get that efficiency, we must address corporate actions. Money and securities are like water; they flow in the direction that offers less resistance. By removing these barriers, we ensure the smooth and efficient flow of securities throughout the European markets.”

Customers can improve internal efficiency as well

A common, harmonised approach to corporate actions also enables customers to increase the efficiency of their internal, or back-office operations. “When we introduced T2S and more harmonised settlement processes, many of our customers were able to streamline their internal procedures, particularly those who issue in multiple currencies,” David Durand comments. “Having one approach to corporate actions will enable our customers to further harmonise their back-office functions. Since this system will apply for all currencies and markets, customers can streamline their internal processes, rather than having to maintain separate processes for euro and local currency issuances.”

New platform creates opportunities for automation

When we modernise our platform and processes, it always creates ways for us to work smarter and more effectively. “One of the benefits of the new system is that all customers will gain access to new functionality and increase the interoperability of their system with Euronext Securities CSDs,” says David Durand. “Whether they issue in euro, or one of the Nordic currencies, everyone will benefit from the new opportunities for self-service, increased flexibility and improved access to relevant information that the system will provide.” Customers will also benefit from increased straight-through processing, which allows for more automation.

Addressing needs of local players

Harmonising market practices across the four Euronext Securities markets will also give each CSD the chance to improve its existing corporate actions processes.

“Harmonising corporate actions creates an opportunity for each CSD to modernise legacy systems and take advantage of more sophisticated approaches to corporate actions. This, in turn, will benefit all our customers, whether they are international, regional, or local players,” Pierre Davoust says.

At the same time, he acknowledges that local players have legitimate, specific needs that the new platform must accommodate. One such example is in Norway, where custodians servicing international clients need a standard way of processing corporate actions payments, whereas local retail clients rely solely on the CSD to process retail operations. To address these local market needs, Euronext Securities will adopt a two-layer approach. “The first layer will be a harmonised approach to market practices that will apply across all CSDs,” Pierre Davoust explains. “Then, when local players need specific, value-added services, we will build these into a second layer, on top of the first. In this way, we will develop a platform that works for everyone in all four markets.”

Wherever they engage with us, our customers will have the same experience, use the same technology and follow the same streamlined, harmonised processes.” – Pierre Davoust, Head of CSDs at Euronext