Oslo – 18 December 2020 – Euronext today congratulates Skitude, the provider of digital platforms for skiers and other mountain enthusiasts, on its listing on Euronext Growth Oslo (ticker code: SKI).

Tech company Skitude Holding AS aims to digitise the market for skiers and other mountain enthusiasts, with a digital platform providing a meeting place between skiers and ski resorts.

Skitude was listed through the private placement of 40,350,794 shares at a price of NOK6.70 per share (€0.633). This includes a total of 29,850,746 new shares, raising gross proceeds of NOK200 million. A total of 5,263,147 shares were over-allotted. Market capitalisation was NOK551 million (€52.5 million4) on the first day of listing. The private placement was well covered and attracted strong interest from Norwegian, Nordic and international high-quality institutional investors.

The listing on Euronext Growth is an important step in Skitude’s long-term vision to create a one-stop shop that offers all services related to mountain activities. The net proceeds from the primary offering will predominantly be used to accelerate organic growth, finance M&A and for general corporate purposes.

Marc Bigas, CEO and co-founder of Skitude, said: “Over the past nine years we have developed a unique technological platform with 1.8 million app users. And the journey has just begun. With the listing of Skitude, we will be stronger and better equipped to pursue Skitude's ambition: To digitalize the world's alpine ski resorts.”

Bent Grøver, Chairman of the Board of Skitude and Investment Manager at Investinor, stated: “The Private Placement and listing will help accelerate our growth as the world's leading player in a significant, but fragmented market with a very strong customer base. We are currently looking at investing in a number of companies and initiatives to bring the alpine world together under one digital platform.”

Euronext is the leading pan-European stock exchange for Tech companies, hosting a total of 500+ Tech issuers across sectors such as Technology, Media and Telecom, Life Sciences and Cleantech. Skitude is the latest in a long list of Tech companies going public in Oslo, such as Pexip and, just this month, Meltwater. Twenty new Tech companies have listed on Oslo Børs’ marketplaces in 2020, the majority of these on Euronext Growth, and more than 10% of the Oslo market capitalisation is now in the Tech sector.

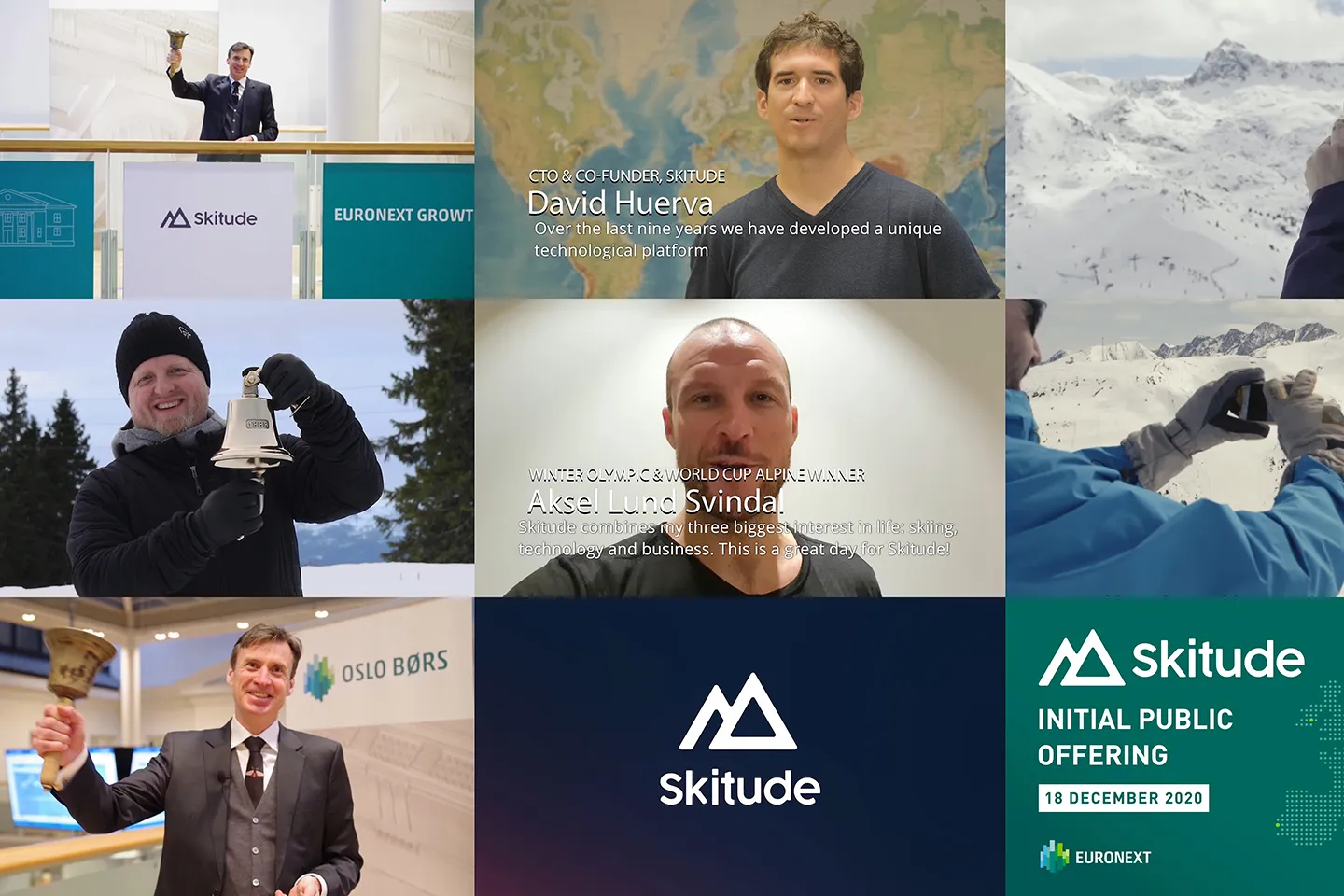

David Huerva, CTO & co-founder of Skitude, Aksel Lund Svindal, shareholder and winter Olympic alpine winner and Bent Grøver, chairman of the company celebrated the listing together with Øivind Amundsen, President & CEO of Oslo Børs. Click here to view the video of the remote bell ceremony.

About Skitude

Skitude Holding AS aims to digitize the market for skiers and other mountain enthusiasts. Unlike other markets such as tourism, accommodation, restaurants, touring etc., this market is still mostly analogue. Skitude Holding AS has developed a digital platform on which all of this can be achieved. As such it provides a meeting place between skiers and ski resorts. The company’s long-term vision is to create a one-stop-shop that offers all services related to mountain activities.