-

Cotation en bourse

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextLire la suite

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextLire la suiteWorld’s largest defence IPO ever recorded.

Learn more about Euronext’s initiatives to enhance financing and visibility for European aerospace and defence companies -

Trading

Where European Government Bonds meet the futureFixed Income derivativesLire la suite

Where European Government Bonds meet the futureFixed Income derivativesLire la suiteTrade Mini Bond Futures on main European Government Bonds

-

Clearing

Step into Europe’s next phase of Repo ClearingRepo ClearingLire la suite

Step into Europe’s next phase of Repo ClearingRepo ClearingLire la suiteEuronext is expanding its repo clearing services to boost market access, liquidity provision and collateral optimisation across Europe.

-

CSD

European CSD modelBuilding the CSD of Choice in EuropeLire la suite

European CSD modelBuilding the CSD of Choice in EuropeLire la suiteEuronext Securities is shaping the future of European capital markets by enhancing integration, connectivity, and innovation.

-

Technology

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Lire la suite

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Lire la suiteThe new generation of high-frequency risk trading platforms, offering the highest performance with ultra-low latency and minimal jitter, all at a low total cost of ownership.

-

Data

-

Indices

Access the white paperInvesting in the future of Europe with innovative indicesLire la suite

Access the white paperInvesting in the future of Europe with innovative indicesLire la suiteThe first edition of the Euronext Index Outlook series with a particular focus on the European Strategic Autonomy Index.

- Réglementation

-

About Euronext

Euronext strategic planInnovate for Growth 2027Lire la suite

Euronext strategic planInnovate for Growth 2027Lire la suiteShaping capital markets for future generations

-

Cotation en bourse

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextLire la suite

Strengthening Europe’s strategic autonomy through capital marketsCzechoslovak Group lists on EuronextLire la suiteWorld’s largest defence IPO ever recorded.

Learn more about Euronext’s initiatives to enhance financing and visibility for European aerospace and defence companies -

Trading

Where European Government Bonds meet the futureFixed Income derivativesLire la suite

Where European Government Bonds meet the futureFixed Income derivativesLire la suiteTrade Mini Bond Futures on main European Government Bonds

-

Clearing

Step into Europe’s next phase of Repo ClearingRepo ClearingLire la suite

Step into Europe’s next phase of Repo ClearingRepo ClearingLire la suiteEuronext is expanding its repo clearing services to boost market access, liquidity provision and collateral optimisation across Europe.

-

CSD

European CSD modelBuilding the CSD of Choice in EuropeLire la suite

European CSD modelBuilding the CSD of Choice in EuropeLire la suiteEuronext Securities is shaping the future of European capital markets by enhancing integration, connectivity, and innovation.

-

Technology

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Lire la suite

Euronext Technology SolutionsHigh-Frequency Trading Solution (HFTS)Lire la suiteThe new generation of high-frequency risk trading platforms, offering the highest performance with ultra-low latency and minimal jitter, all at a low total cost of ownership.

-

Data

-

Indices

Access the white paperInvesting in the future of Europe with innovative indicesLire la suite

Access the white paperInvesting in the future of Europe with innovative indicesLire la suiteThe first edition of the Euronext Index Outlook series with a particular focus on the European Strategic Autonomy Index.

- Réglementation

-

About Euronext

Euronext strategic planInnovate for Growth 2027Lire la suite

Euronext strategic planInnovate for Growth 2027Lire la suiteShaping capital markets for future generations

- Accueil

- About

- Media centre

- Bell Ceremony Archive

- ACTIVITE EN EUROPE

ACTIVITE EN EUROPE

Montant des capitaux levés sur les marchés d’Euronext en 2013

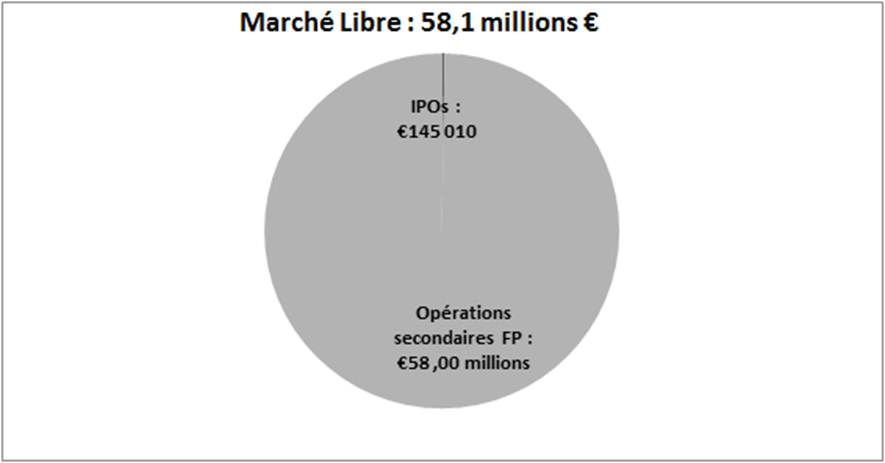

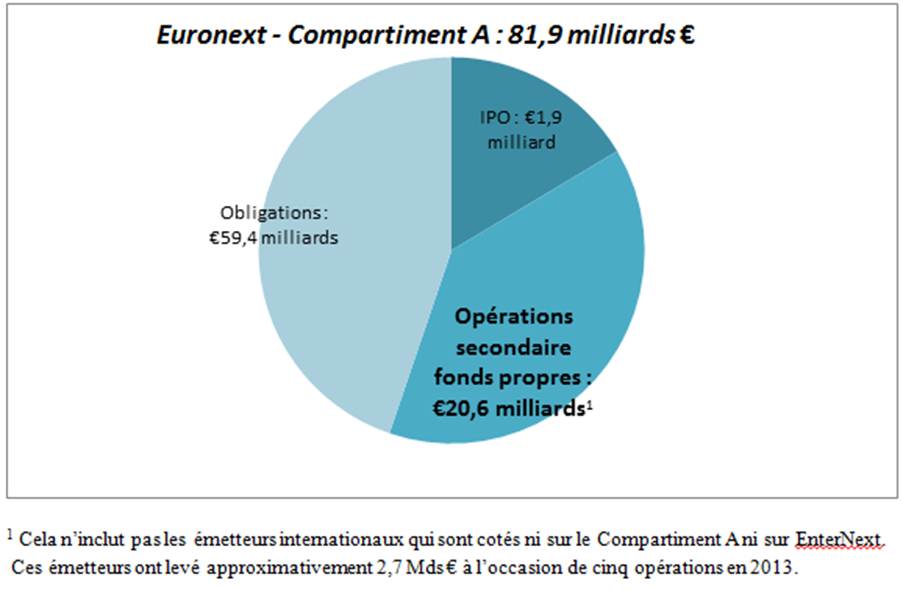

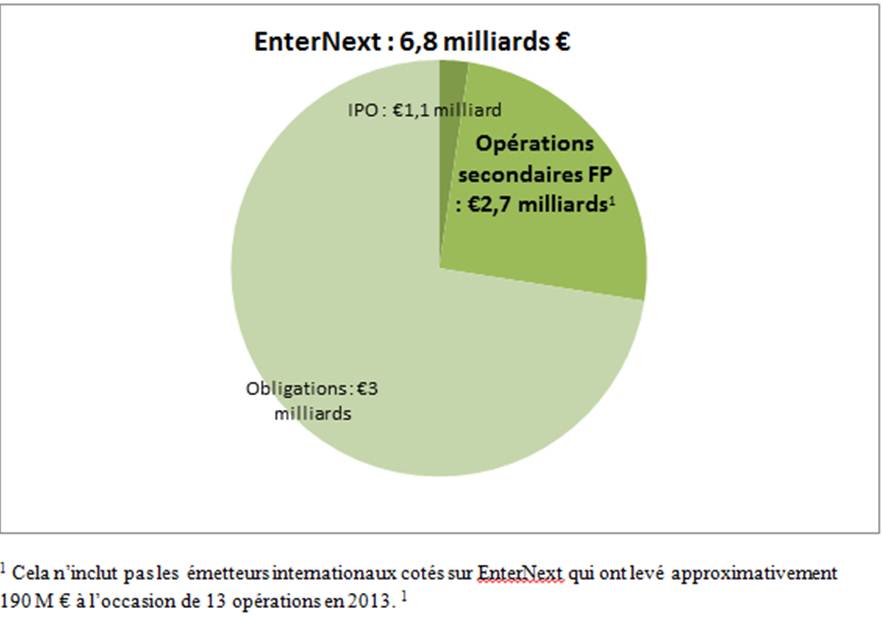

Les entreprises cotées sur Euronext et EnterNext ont levé 92 milliards d’euros en 2013, dont 81,9 milliards sur le Compartiment A d’Euronext et 6,8 milliards sur EnterNext, le nouveau marché paneuropéen dédiés aux PME-ETI1.

Les cinq augmentations de capital les plus importantes sur le Compartiment A d’Euronext en 2013

|

Date |

Entreprise |

Opération |

Montant levé (€millions) |

|

17 mai |

KPN KON |

Emission suite à une offre publique |

4 766 |

|

3 juin |

ASML Holding |

Placement privé |

2 296 |

|

14 jan |

ArcellorMittal |

Placement privé |

1 340 |

|

9 déc |

Alcatel-Lucent |

Emission suite à une offre publique |

956 |

|

23 déc |

Royal Dutch Shell |

Dividende en actions |

949 |

Les cinq augmentations de capital les plus importantes sur EnterNext en 2013

|

Date |

Entreprise |

Opération |

Montant levé (€millions) |

|

5 déc |

CTT Correios Portugal |

IPO avec levée de capitaux |

579 |

|

24 avril |

Belvédère |

Emission reserve |

347 |

|

25 nov |

Nieuwe Steen |

Placement privé |

345 |

|

17 déc |

Caixa Economica Montepio Geral |

IPO avec levée de capitaux |

200 |

|

28 mai |

Vivalis |

Levée de capitaux |

134 |