Euronext Securities Porto dedicates a rigorous and permanent attention to the maintenance of a prudent risk profile, balanced and adequate to the experience and capacity of the organization, preserving the basic objectives of solvency, profitability and adequate liquidity.

Euronext Securities Porto embeds the risk management philosophy into the Company culture, in order to make risk and opportunity management a regular and everyday process for its employees.

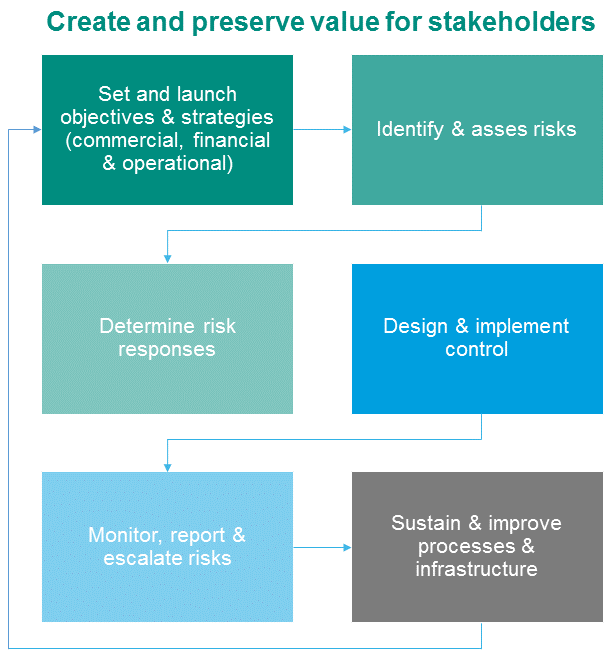

Euronext Securities Porto Managing Board regards the Risk Framework as a key management process, allowing management to effectively deal with risks and opportunities, in compliance with related laws and regulations.

Euronext Securities Porto promotes the adequate monitoring

and evaluation of identified risks.

Euronext Securities Porto, as a Centralised Securities Systems and Securities Settlement Systems management entity, has a risk and internal control system which purpose is to monitor the risks inherent to its activity, minimize contingencies, adapt to changes in the economic and competitive environment and market changes, as well as, a more effective development and growth of the company.

In order to mitigate the risks inherent to the systems it manages and, consequently, to its business, Euronext Securities Porto has in place rules, contained in regulations, circulars and notices, which describe the procedures governing the Centralised Securities Systems and the Securities Settlement Systems.

Euronext Securities Porto has implemented a Business Continuity Plan (BCP) that aims to guarantee the permanent operation of its services and systems with the highest level of security, reliability and availability.

The Business Continuity Plan is tested annually, both internally and with different market players.